Services Offered by Securities Firms versus Investment Banks - PowerPoint PPT Presentation

1 / 13

Title:

Services Offered by Securities Firms versus Investment Banks

Description:

Stock Brokerage - trading of securities on behalf of individuals. Electronic Brokerage - offered by ... Long positions in securities/commodities 514,949.9 23.33 ... – PowerPoint PPT presentation

Number of Views:62

Avg rating:3.0/5.0

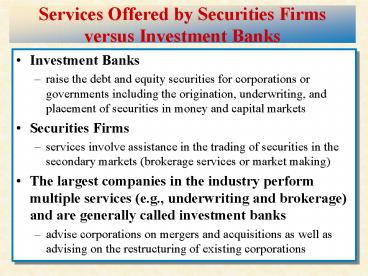

Title: Services Offered by Securities Firms versus Investment Banks

1

Services Offered by Securities Firms versus

Investment Banks

- Investment Banks

- raise the debt and equity securities for

corporations or governments including the

origination, underwriting, and placement of

securities in money and capital markets - Securities Firms

- services involve assistance in the trading of

securities in the secondary markets (brokerage

services or market making) - The largest companies in the industry perform

multiple services (e.g., underwriting and

brokerage) and are generally called investment

banks - advise corporations on mergers and acquisitions

as well as advising on the restructuring of

existing corporations

2

Size, Structure, and Composition of the Industry

- Three major types of firms

- national full-line investment banks that service

retail and corporate customers (e.g., Merrill

Lynch) - national full-line firms that specialize more in

corporate finance (e.g., Goldman Sachs) - the remainder of the industry and includes four

classes - specialized investment bank subsidiaries of

commercial banks - specialized discount brokers

- regional securities firms

- specialized electronic trading securities firms

3

Securities Firm and Investment Bank Activity Areas

- Securities firms and investment banks engage in

as many as seven key activity areas - Investing

- Investment Banking

- Market Making

- Trading

- Cash Management

- Mergers and Acquisitions

- Other Service Functions

4

Investing

- Involves managing pools of assets such as mutual

funds - Compete with commercial banks, life insurance

companies, and pension funds - Manage funds either as agents for other investors

or as principals - Objective is to select asset portfolios to beat

some return-risk performance benchmark such as

the SP 500

5

Investment Banking

- Refers to activities related to underwriting and

distributing new issues of debt and equity

securities - Industry is dominated by a small number of

underwriting firms - Securities underwriting can be undertaken through

either public or private offerings - Private placement - securities issue placed with

one of a few large institutional investors - Public placement - may be underwritten on a best

efforts or firm commitment basis and offered to

the public

6

Market Making

- Involves the creation of a secondary market in an

asset by a securities firm or investment bank - Either agency or principal transactions

- Agency transactions - two-way transactions on

behalf of customers - Principal transactions - the market maker seeks

to profit on the price movements of securities

and takes long or short inventory positions for

its own account

7

Trading

- Closely related to market-making activities

- Six types of trading

- Position trading - purchases of large blocks on

expectation of favorable price move - Pure Arbitrage - buying an asset in one market

and selling it immediately in another market at a

higher price - Risk Arbitrage - buying securities in

anticipation of some information release - Program Trading - simultaneous buying and selling

using a computer program to initiate such trades - Stock Brokerage - trading of securities on behalf

of individuals - Electronic Brokerage - offered by major brokers,

direct access via internet to trading floor

8

Cash Management

- Securities firms and investment banks offer bank

deposit-like cash management accounts (CMAs) to

individual investors - money market mutual fund sold by investment banks

that offer check-writing privileges

9

Mergers and Acquisitions

- Frequently provide advice on, and assistance in,

mergers and acquisitions - assist in finding merger partners

- underwrite any new securities

- asses the value of target firms

- recommend terms of the merger agreement

- assist target firms in preventing a merger

10

Other Service Functions

- Custody and escrow services

- Clearance and settlement services

- Research and advisory services

11

Balance Sheet Assets

Assets Cash

27,780.4

1.26 Receivable from other broker-dealers

766,399.7 34.72 Receivable from

customers 135,723.3

6.15 Receivables from noncustomers

19,296.1 0.87 Long positions

in securities/commodities 514,949.9

23.33 Securities and investments not marketed

8,833.8 0.40 Securities purchased

w/resell agreement 647,360.8

29.33 Exchange membership

933.0 0.04 Other

assets

85,964.0 3.90 Total assets

2,111,191.2 100.00

12

Balance Sheet Liabilities

Liabilities Bank loans payable

47,363.2

2.15 Payables to other broker-dealers

361,774.7 16.39 Payables to

noncustomers

39,604.9 1.79 Payables to customers

239,797.3

10.86 Short positions in securities/commodities

263,219.8 11.93 Securities sold

w/repurchase agreements 933,214.3

42.28 Other nonsubordinated liabilities

170,715.5 7.73 Subordinated

liabilities

55,501.5 2.52 Total liabilities

2,111,191.2

95.65 Capital Equity capital

96,049.8

4.35 Number of firms

7,785

13

Regulation

- The primary regulator of the securities industry

is the Securities and Exchange Commission (SEC)

established in 1934 - SEC sets rules governing securities firms

underwriting and trading activities - The Securities Investor Protection Corporation

(SIPC) protects investors against losses of up to

500,000 on securities firm failures