Foreign investment - PowerPoint PPT Presentation

Title:

Foreign investment

Description:

Project financing through international institutions International lenders (financing institutions) An important player is the World bank: comprises 5 institutions: – PowerPoint PPT presentation

Number of Views:41

Avg rating:3.0/5.0

Title: Foreign investment

1

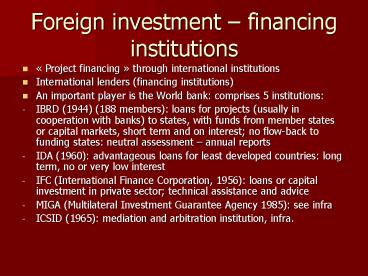

Foreign investment financing institutions

- Project financing through international

institutions - International lenders (financing institutions)

- An important player is the World bank comprises

5 institutions - IBRD (1944) (188 members) loans for projects

(usually in cooperation with banks) to states,

with funds from member states or capital markets,

short term and on interest no flow-back to

funding states neutral assessment annual

reports - IDA (1960) advantageous loans for least

developed countries long term, no or very low

interest - IFC (International Finance Corporation, 1956)

loans or capital investment in private sector

technical assistance and advice - MIGA (Multilateral Investment Guarantee Agency

1985) see infra - ICSID (1965) mediation and arbitration

institution, infra.

2

IBRD

3

Financing institutions

- International lenders (financing institutions)

- Regional development banks African DB, Asian

DB, Inter-American DB .... often on condition of

flow-back to funding countries - BERD (European Bank for reconstruction and

Development) for Eastern Europe capital from

EU countries, US, Canada, Japan - Investment Funds of the EU

- - ACP countries (Cotonou agreement) investment

facilities - - EU-internal European investment Bank

(projects for regional development) - - European Social Fund

- UN-organisations, esp. UNDP

4

Investment law questions - sources

- Main questions of (investment) law / investment

regime - requirements for foreign investment, treatment

of foreign investors, protection against

expropriation - Sources for rules on foreign investment

- National law

- International Investment Agreements (IIAs),

either (mostly) Bilateral investment treaties

(BIT) (s. infra) or Multilateral treaties

(regional, sectorial, TRIMS, world bank treaties)

(s. infra) - Customary international law, esp. concerning

protection in case of expropriation (s. infra) - Investment contracts, i.e. contracts between

investor and host country - Main questions (s. next slide)

- Applicable law domestic law or international

public law ? quasi-international law ? - Effect of stabilisation clauses

- Dispute resolution mechanism ?

5

Problems of applicable law

- Why may domestic law (of the host state) be

problematic ? - protectionism obligation to buy in the guest

country (performance obligations, infra)

restrictions on import / export, restrictions on

transferring (expatriating) profit , - using sovereignty, eg limited protection against

expropriation - sometimes also reverse discrimination of

nationals, privileges for foreign investors - TRIMS 1994 only trade related aspects of

investments - Principle of national treatment

- Prohibition of quantitative measures and measures

with similar effect - Can investment contracts help ?

- - Contain eg stabilisation clauses (compare infra

in BIT) - - Effectiveness against host country depends on

applicable law and competent jurisdiction (most

effective is application of international public

law and international arbitration)

6

Protection ag. expropriation

- Esp. protection against expropriation

- Types of expropriation individual expropriation

s.s. (public interest compensation) collective

nationalisation confiscation creeping

expropriation or quasi-expropriation

(disproportionate burdens or restrictions) (lot

of disputes as to what amounts to expropriation) - Expropriation and international law ?

- In European countries 1st Protocol to the ECHR

- Rules of customary public international law ?

Next 2 slides

7

Protection ag. expropriation

- Traditional customary public international law

has as rules conditions for expropriation - - No general prohibition

- Allowed only in the public interest (but

interpreted thus that poliical purposes are not

excluded) - No discrimination of foreigners (unless required

for national security) - Effective Prompt Appropriate Compensation

(Hull-formule) (i.e. quick, in convertable and

exportable currency, full value) - Due process of law (procedural protection)

8

Protection ag. expropriation

- Traditional customary public international law

questioned - by the USSR 1917, Latin Am. (Calvo doctrine),

developing countries, . - UN-Resolution no. 1803 from 1962 stresses

permanent sovereignty over natural resources of

every state (host state for investments) - A more radical Charter of economic rights and

duties of States in 1974 ( new economic

order ). - NEO-Charter proposed to extend the sovereignty to

include all economic activities, does not require

public interest , grants only reasonable

compensation, refuses international procedural

control, etc. - Such expropriations will however not be

recognised by other countries - Thus not accepted as customary law, meanwhile

slipped into oblivion (Reaction after 1974s

BITs)

9

Investment treaties

- Uncertainty about the customary international

public law creates need for treaties - Next slides multilateral treaties bilateral

treaties - Foundation of 2 new institutions under the world

bank - - ICSID 1965

- - MIGA 1985

10

Multilateral Investm. Treaties

- Multilateral investment treaties ?

- OECD OECD-MiA failed negotiations on a GIT in

WTO failed - FTAs (Free Trade Agreements) contain also

investment protection, as in - NAFTA Ch. 11 non-discrimination investor

chooses dispute resolution - Mercosur

- COMESA

- EU / Canada Parternship (2013)

- (EU internal market as a more radical solution)

- Other Regional ITs, such as

- Investments agreement of the OIC (Bagdad 1981)

- Sectorial Energy Charter Treaty 1994 on next

slide - Also investment aspects in Cotonou (EU / ACP),

supra - TRIMS, supra

- Codes of conduct of the World Bank, OECD, UN

Global Compact , - World bank related treaties infra

11

Energy Charter Treaty

- Sectorial Multilateral investment treaties ?

- Sectorial Energy Charter Treaty 1994

- 46 countries from Europe (incl. EU itself),

former Soviet U Japan (Russia withdraw in

2009) - Oil electricity

- Concerns investment / exploitation / transport

- Principle of non-discrimination

- Protection against expropriation and

quasi-expropriation - Dispute resolution mechanism (arbitration)

- E.g. Procedures by Vattenfall v. Germany (i.a.

decision to close nuclear plants)

12

Energy Charter Treaty

13

Bilateral Inv. Treaties (BIT)

- Bilateral investment treaties (BIT) (also known

as Foreign Investment Promotion and Protection

Agreements, FIPAs) - BITs in response to the NEO-Charter

- gt In 2011 almost 3000 BITs (57 with Belgium,

127 with Germany, etc.) - (big countries have model BIT)

- Some countries are terminating their BITs, eg

South Africa (BIT w. Belgium, Spain)(Black

Economic Empowerment ) Bolivia Ecuador left

ICSID

14

BITs

15

Bilateral Inv. Treaties (BIT)

- Fate of Extra-EU-BITs after Lisbon Treaty

Reg. 1219/2012 - EU intends to replace national

Extra-EU-Bits by common BITs. Duty of MSs to

eliminate incompatibilities - Scope of application (usually)

- (Inward) investment, usually broadly defined (FDI

foreign direct investment) - Sometimes restricted to certain investments or

under certain conditions

16

Bilateral Inv. Treaties (BIT)

- Typical content

- Freedom to invest ? (free inflow and outflow of

capital) - Usually not fully liberalised

- Usually no full national treatment, but a MFN

clause minimum standard of proper

equitable treatment - Incl. often prohibition of performance

requirements (such as requirement of

national content of products ) (conflicts

with EU quota rules) - Protection of investments made

- Stabilisation clauses (later regulation cannot

negatively affect the investment) observance

clauses (later regulations not applicable)

validity (binding character) is sometimes

disputed - Usually rules on protection in case of

expropriation, - Capital transfer guarantees (free movement of

capital) (some coNflicts with EU law) - Dispute resolution next slide

17

Bilateral Inv. Treaties (BIT)

- Typical content (cont.)

- Dispute resolution

- Renegotiation clauses

- Arbitration clauses

- usually ICSID arbitration (next slide)

- sometimes subject to a national court requirement

(eg UK-Argentina first go to the Argentinian

court if no decision within 18 months

arbitration is open) - Arbitration may be under the ICSID rules (infra)

or under UNCITRAL rules (see Ch. 12) (the latter

may impose however some transparency

requirement, i.e. some information is to be made

public)

18

ICSID

19

Investment treaty arbitration

- ICSID Convention 1965 Dispute resolution

procedure for investments disputes - now 149 ratifications ( 9 signatures) became

much more important since the 1990s. Missing

i.a. India, Brazil, South Africa, Russia not

ratified, Canada not ratifed (federalism problem)

- Scope of application

- only investment disputes

- between a party to the ICSID Convention and an

investor from another contracting party (or a

local daughter company) - jurisdiction of the ICSID has been accepted in an

investment contract, domestic law, BIT or ad hoc - ICSID organises the procedure, does not settle

the dispute itself - Conciliation procedure (not succesful)

- Arbitration procedure

- Dispute whether still possible under intra-EU

BITs (according to EU Commission, contrary to

344 TFEU case pending before German BGH)

20

Investment treaty arbitration

- Advantages of ICSID Arbitration

- If a choice of law was made in the contract, the

arbitrators must apply that law - But national law can be set aside if contrary to

public international law (art. 42 ICSID) - Arbitral award can be set aside only by ICSID

itself, not by a national court limited grounds

for annulment - Exclusive jurisdiction national courts lose

jurisdiction no immunity of jurisdiction for

ICSID states before ICSID - Member states recognise the awards as binding and

guarantee the enforcement within their territory

nevertheless enforcing often remains difficult - Additional facility ICSID assistance in

cases out of the scope of application of the

Convention (eg investor not a national of an

ICSID State) - Awards are published in annual Reports

- Criticism no guarantees for fair trial

impartiality, no public character, nu guarantee

of consistent interpretation by a single

tribunal, etc

21

MIGA

- MIGA Multilateral Investment Guarantee Agency)

1985 mainly covers non-commercial risks of

investors from MIGA-member countries in other

MIGA-countries succesful (168 members)) - Coverage can be granted by MIGA after assessment

of risks if - An investment is made (interpreted widely)

- By an investor from a MIGA-country

- After the granting of the guarantee (only new

investments) - In a developing country, member of MIGA

- - Contributing to development

- Approval by the host country is required usually

MIGA will contract with the country to limit the

risks - Risks that can be covered mainly 4 types

currency transfer restrictions expropriation and

similar measures breach of contract without

domestic remedy sometimes war and civil

disturbance. Not eg devaluation - Conditions will be specified in a contract

MIGA-investor premium to be paid uninsured

percentage (usually 10 ), arbitration clause - Disputes between MIGA-states on the Convention

submitted to Board of MIGA - Disputes MIGA - host country negotiation if

necessary arbitration