LA GLOBALISATION: Un d PowerPoint PPT Presentation

1 / 99

Title: LA GLOBALISATION: Un d

1

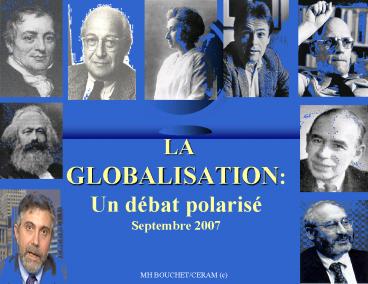

LA GLOBALISATIONUn débat polariséSeptembre

2007

2

Les théories du Développement

3

Un débat polarisé

Jeune à somme gt 0 win-win Un processus inéquitable

Economistes classiques Adam Smith, David Ricardo, Benjamin Constant, Frédéric Bastiat, Fridriech Hayek Karl Marx, F. Engels, Lénine, Rosa Luxembourg

Economistes contemporains Kenneth Arrow, Milton Friedman, Walter Rostow, Robert Lucas, Jagdish Bhagwati, Anne Krueger, Stanley Fisher, Rüdiger Dornbusch, Alan Greenspan, Kenneth Rogoff Paul Prebish, Hans Singer, Paul Baran, Paul Sweezie, Arghiri Emmanuel, Harry Magdoff, Immanuel Wallerstein, Samir Amin, Gunther Franck, Bernard Maris

Essayistes et sociologues Martin Wolf, Francis Fukuyama, Kenichi Ohmae, Peter Drucker Pierre Bourdieu, Alain Joxe, Dominique Wolton, Joel Bakan, Susan Strange, M. Foucault, Bernard Stiegler

Institutions académiques NGOs Heritage Foundation, Cato Institute, IIE ATTAC, Oxfam

IFIs FMI, OECD, IIF CNUCED/UNCTAD, ECLA, CEPAL

4

Un débat polarisé

Au centre du débat la question de lharmonie

spontanée dans le marché, de la légitimité et de

lefficacité de lintervention de lEtat, et

celle du caractère volontaire ou non du chômage

- Néo-classiques et monétaristes

- intervention inutile et néfaste de lEtat

- Le marché est le seul mode dallocation des

ressources - Agent individuel rationnel

- Le système économique a une faculté

dauto-régulation - À moins dune inflation croissante, le chômage ne

peut être maintenu lt taux naturel - La fonction de demande de monnaie est stable en

longue période, doù la nécessaire modération de

lexpansion monétaire

- Keynésiens et interventionnistes

- Intervention nécessaire

- Chômage de longue période par insuffisance de

demande - Importance du multiplicateur

- Rôle positif du multiplicateur pour accompagner

la relance - Pas déquilibre spontané et durable sans

régulation

5

I- La Doctrine Libérale

- Une économie de marché auto-régulée

- Une intervention publique aussi limitée que

possible - Un rôle clé de linitiative privée et de la

concurrence

6

Des classiques aux néo-classiques

7

Les pères fondateurs de lécole libérale

- Colbert (1660) lEtat ne doit pas se substituer

aux entreprises mais leur fournir un cadre

favorable (infrastructures, éducation, recherche,

politique industrielle) - Gournay (1750) Laissez-faire, laissez passer

- Adam Smith 1776 The Wealth of Nations Natural

order stems from individual choices with minimal

state involvement natural harmony - David Ricardo (1817) Principles of Political

Economy and Taxation the law of comparative

advantage a positive sum game for all countries!

- James Mill (1821) Elements of Political Economy

exporting for importing (against the

mercantilists)

8

La coïncidence entre le commerce

laissez-faire , la croissance et le bien-être

Les pères fondateurs du libéralisme économique

Montesquieu (1689-1755) Turgot (1727-1781)

9

Adam Smith (1723 1790)

- Adam Smith, Scottish philosopher and economist

"The Wealth of Nations", on free trade and market

economics (1776) "Little else is required to

carry a state to the highest degree of opulence

from the lowest barbarism but peace, easy taxes,

and a tolerable administration of justice."ADAM

SMITH, 1755

10

Adam Smith

- Adam Smith heavily influenced economic thought

throughout the Victorian Era. Generally

considered the "father of modern economics. - Competition, the market's invisible hand, would

lead to proper pricing. - Strongly opposed any government intervention into

business affairs. Trade restrictions, minimum

wage laws, and product regulation are detrimental

to a nation's economic health. - Smith was not an apologist for the capitalist

class.

11

Theory of Absolute Advantage

- Wealth of the Nations (1776) Adam Smith

promoted free trade by comparing nations to

households - It is the maxim of every prudent master of a

family, never to attempt to make at home what it

will cost ... more to make than to buy. The

tailor does not attempt to make his own shoes,

but buys them from the shoemaker ... - What is prudence in the conduct of every private

family, can scarce be folly in that of a great

kingdom. If a foreign country can supply us with

a commodity cheaper than we ourselves can make

it, better buy it of them with some part of the

product of our own industry employed in a way in

which we have some advantage.

12

Absolute Advantage

- A country has an absolute advantage over another

in the production of good X when an equal

quantity of resources can produce more X in the

first country than in the second - higher productivity!

13

David Ricardo (1772 1823)

- David Ricardo, working in the early part of the

19th century, realised that absolute advantage

was a limited case of a more general theory. - Theory of Comparative advantage

- Major work On the Principles of Political

Economy and Taxation (1817)

14

David Ricardo

- In the aftermath of Napoléons defeat, in 1815,

British peasants consider that maintaining

agricultural protectionism is a key to national

security. - Meanwhile, British industrialists want to achieve

a decline in the price of wheat and of wages

through import liberalization. - Rising food prices and rising wages will squeeze

industrial profits and only trade can lower

costs. - Each and every nation gets interest in

specializing its production in those goods where

it has comparative advantage depending on

each nations endowments (labor, capital, land).

- Free trade will then increase global welfare

15

Comparative Advantage

- What if one country can produce all commodities

more efficiently than other countries? - In essence this was the question David Ricardo

posed in 1817 (industrial revolution) - Ricardos answer underlies the theory of

comparative advantage potential gains from

trade. - The gains from specialisation and trade depend on

the pattern of comparative, not absolute,

advantage.

16

Comparative Advantage

- A difference in comparative costs of production

the necessary condition for international

exchange to occur does, in fact, reflect a

difference in the techniques of production, the

capital and labor inputs, and productivity. - The theory aims at showing that trade is

beneficial to all participating countries - win/win!

- Positive-sum game of international trade!

17

The Liberal economics school

- Samuelson Ricardo is right but

- Though they are both winers and losers, the

winners gains exceed the losers losses.

Productivity gains in Chinas export sector raise

total wealth in each country China and the US. - But technical progress in China can also improve

productivity in export goods competing with the

US! Chinas advances in semiconductors or

Indias in financial services. - Then, trade can turn entirely to the poor

countrys advantage.

18

Samuelson on the limits of trade benefits (2004)

- The aggregate economic gains to a nation from

trade may decline in the future if other nations

become more productive in those sectors in which

the rich country now holds a comparative

advantage. The benefits of trade that derive

from specialization are diminishing. - However, protectionism breeds monopoly, crony

capitalism and recession pursuing open trade and

competition is the better option for promoting

overall growth and prosperity! - Endless productivity growth race!

19

Modern liberal scientists

- Walter Rostow take-off paradigm

- Huntington the Institutional development school

- The approch to development of the IFIs (FMI)

- Arthur Laffer (Chicago, South Carolina)

- Milton Friedman (Chicago) Monetarism

- Gary Becker (Chicago, Nobel Prize 1992)

- James Buchanan (Nobel Prize, 1986)

- Robert Lucas

- Paul Samuelson

- Jagdish Bhagwati

- Martin Wolf (FT)

20

The liberal think-tanks

- Mount Pelerin Society of liberal supply-side

economists created in 1947 by Friedrich von Hayek - Hoover institution (Standford University)

- Cato Institute (www.cato.org)

- American Enterprise Institute

- Washington -based Heritage Foundation

21

The neoclassical liberal school

- Economic development is rooted in market-driven

economic policies, in cautious monetary

management, and in trade liberalization - Low taxes and minimum public sector budget

deficit!

22

Milton Friedmans approach to economic growth and

development

- Economic developments roots?

- ? free-market economy

- minimum state intervention cautious monetary

management non-inflationary economic growth - Consumers warrant more importance than citizens.

- Capitalism and Freedom-1962

23

Friedmans approach to economic growth

- Diagnosis from 1865 to 1965, average US economic

growth (excepted 1930 crisis) has been 4.0

since 1965, however 2.5 due to excessive state

intervention and over-regulation. - Money matters Policy-makers cannot have

long-term influence on interest rates, on

employment rate, and on growth rate. The only

justified policy mission is avoiding both

inflation and depression. The only variable under

the control of decision-makers is price stability

through prudent monetary management regular and

moderate expansion of domestic money supply. - Keynesian anticyclical monetary policy is

pointless and doomed to failure due to complex

and uncertain lags between money supply, prices

and growth.

24

Friedmans approach to economic growth

- Liberal revolution could close the gap between

potential output of 6 yearly and current average

growth of 2-3. - Recommendation limiting public spending as a

proportion of GDP as much as possible. - Hong-Kong as a target 15/20 of GDP (vs. 50 in

France) with GDP per capita equal to the US

level. - The lesser the state intervention,

- the better!

25

Les bases théoriques du monétarisme

- Monetary policy must be totally free from state

intervention independence of the Central Bank

and currency boards in EMCs - Conclusion

- 1. Economic crises have nothing to do with

capitalism vulnerability but with bad economic

policies - 2. The market remains the best coordination

instrument with minimum state intervention - 3. The cause of most economic crises is the

intervention of the welfare state - 4. The role of lender of last resort of the IMF

and the resulting moral hazard increase the

probability and the severity of financial crises.

26

The emphasis on market-based economic policies

- It is safe to say that we are witnessing this

decade, in the United States, historys most

compelling demonstration of the productive

capacity of free people operating in free

markets. - Alan Greenspan, December 1999

- Globalization is an endeavor that can spread

worldwide the values of freedom and civil contact

the antithesis of terrorism!. - Alan Greenspan (2003)

27

The neoclassical liberal school

- Robert J. Lucas, Robert Barro, and Thomas J.

Sargents central assumption of "rational

expectations", which assumes that actors in the

economy are smart and forward looking and

therefore attempt to predict the policies that

government is going to implement. - Excessive state intervention creates moral

hazard (bail out of US Savings Loans in 1990,

Japans financial system in 1999, Frances Crédit

Lyonnais...)

28

The neoclassical liberal school

- Robert Lucas

- While income inequalities rose in the 20th

century, the 21st century will see a convergence

trend - since all countries have access to the same

technology and institutions and adopt

market-friendly economic policies, with fully

mobile capital, the process of catch-up will take

place as capital flows from rich to poor

countries.

29

The Liberal economics school

- James Buchanan Gordon Tullock (The Calculus of

Consent), against the distortion of majority

rule in parliamentarian democracy (the

dictatorships of organized minorities) influenced

by Friedrich Hayeks The Constitution of

Liberty - liberal interpretation of democracy ? rule of law

and principle of generality ? simple majority

rule can be applied only to general laws without

any embodied discrimination.

30

Les Étapes de la CROISSANCE

- Les différentes approches des étapes du

développement socio-économique

31

The stages of Growth

- Expressing the growth process as a sequence of

stages instead of a simple chronological story - Karl Marx feudalism gave way to bourgeois

capitalism to be followed by socialism and then

communism - Karl Bücher and German historiography

household economy in the antiquity, then the

town economy of the late Middle Ages, and

thereafter the national economy of modern

times. - Aim to design a model by specifying and isolating

a limited number of factors in different stages

to help predict change

32

Walter ROSTOWs take-off approach to economic

development

- An historical approach to the underlying economic

conditions of self-sustaining economic growth

33

Walt W. Rostow Born in 1916 in NYC, primarily

known for his development of the linear stages

theory of economic development in "The Stages of

Economic Growth- A Non-Communist Manifesto".

1950 to 1961 Professor of Economic History at

MIT. 1961-66 Council Chairman for the State

Department of Policy Planning 1966-69 Special

Assistant to the President for National Security

Affairs 1969 Presidential Medal of Freedom by

President Kennedy "as an honor for distinguished

civilian service in peace time." )

34

Take-off approach to economic development

- During economic development societies pass

through 5 stages - The traditional society,

- the pre-conditions for take-off,

- the take-off,

- the drive to maturity, and

- maturity (mass consumption)

35

Take-off approach to economic development

- Requirements for the take-off

- Rise in the rate of productive investment from 5

to gt10 of national income - Development of manufacturing sectors

- Existence of a political, social and

institutional framework which exploits the

impulses to expansion in the modern sector

36

A linear process of economic development...

- W. Rostow s Stages of Economic Growth the

take-off approach

OECD outside Korea and Mexico

Taiwan South Korea Chile

Take-off Stage

Maturity Stage

Latin America Asia Eastern Europe

Economic Growth

India Pakistan China

Africa

Stages 1-2 3 4 5

37

Economic growth in emerging market countries

- Annual Growth in GDP (real PIB/h base 100 en 1970)

38

Economic growth in emerging market countries

- Annual growth in GDP (real per capita GDP/ base

100 in 1970)

39

Net Private Capital Flows to EMCs

In US billion

Source IIF

40

Samuel HUNTINGTON

- Political order in changing societies

- The Clash of Civilization

41

From Economic growth to sustainable development

- Political order in changing societies

- Probing the conditions under which societies

undergo rapid and disruptive social and political

change - The primary problem of politics is the lag in the

development of political institutions behind

social and economic change - Growth extends political consciousness, broaden

political participation, and multiply political

demands - Instability stems from rapid social change and

rapid mobilization of new groups into politics

coupled with slow development of political

institutions

42

Political order in rapidly changing societies

Process of socio-economic change

EMCs

Deficit of strong institution-building capacity

Strength

Obedience

Process of political institutionalization

Duty

Right

43

Le progrès, cest le mouvement contrôlé!

- je vois dans lEurope une barbarie

attentivement ordonnée, où lidée de la

civilisation et celle de lordre sont chaque jour

confondues - Malraux, la tentation de lOccident (1926)

44

The IMF Approach to Economic Growth and

Development

- Development is economic growth those conditions

that make it sustainable, i.e. social

mobilization, good governance, macro-economic

stabilization institutional development... - A country cannot have a sustained economic

adjustment unless the government gets its

budgetary house in order - Setting the prices right interest rates,

exchange rates, domestic prices, agricultural and

commodity prices - Institutional changes staffing, training,

education, procedures, laws, regulations...

45

The IMF and World Bank Approach to Economic

Growth and Development

- Sustainable development stems from a combination

of sound economic policies, growth, and

institutionalization with timely structural

reforms - Stabilizing the macroeconomic situation

- Reducing the size of the public sector as the

private sector is the main engine for growth - Reform of the regulatory framework

- Good governance

46

Monetary Approach to the Balance of Payments

- J. Polak (IMF/1957) Harry Johnson (1975)

- Robert Mundell (1975)

- Easy to apply in LDCs as monetary statistics are

readily available - Easy to modelize for IMF staff missions with

macroeconomic projections - Easy to impose IMFs domestic credit ceilings as

major policy instrument of demand management

domestic credit is the appropriate policy

instrument for the control of the balance of

payments.

47

The IMF Approach to Economic Growth and

Development

The Monetary approach to the balance of payments

The MABP stresses the role of money in the

adjustment process. The Balance of payments

boils down to a monetary phenomenon, driven by

the relationship between the demand for and the

supply of money. It is concerned with long-term

equilibrium. It disregards devaluation as

bringing about a temporary change in relative

prices without any lasting effects on real

variables! A balance of payments disequilibrium

is rooted in a discrepancy between demand and

supply of money. Surplus MdgtMs Deficit MsgtMd

and people will get rid of the excess supply of

money through investment abroad, imports,

purchases of foreign goods and financial assets...

48

The IMF Approach to Economic Growth and

Development Policy implications

- To boost domestic economic activity, the

government resorts to high public spending,

laxist domestic credit policy, and low taxes.

This results in sharp rise in PSBR that is

financed by the government selling debt to the

central bank - ? increase in the monetary base and money supply

? increase in domestic spending ? increase in

imports and financial assets ? wider balance of

payments deficit and downward pressure on the

exchange rate ? offsetting central bank

intervention on the exchange market ? reduction

in monetary base and money supply to avoid a rise

in import prices and inflation. - Monetary base MB commercial bank reserves plus

currency in circulation

49

The IMF Approach to Economic Growth and

Development Policy implications

- In terms of country risk assessment, central

banks balance sheet information will convey

timely signals about the direction of fiscal and

monetary policies and about the foreign exchange

operations of the central bank. - In particular, official foreign assets and

domestic assets (loans to government and loans to

banks) will be interpreted as signals of

stabilization or run-away domestic policy.

50

Roots of domestic macroeconomic

imbalances

Excessive growth in money supply

Excessive absorption

Inflationary pressures

High rates of spending on domestic and foreign

goods

Balance of payments pressures

Stabilization policy with exchange rate

adjustment and control of the money supply

decrease in creation of reserve money given the

money multiplier of the deposit money banks,

interest rate rise, and increase in reserve

requirements Fiscal adjustment Structural

measures to stimulate domestic supply

ADJUSTMENT

51

Consensus de Washington Les dix

commandements de la gestion économique

soutenable John Williamson (IIE 1990)

- Discipline budgétaire afin de limiter les besoins

de financement du secteur public auprès du

système bancaire national - Orientation des dépenses publiques en faveur des

secteurs sociaux - Réforme fiscale

- Libéralisation des taux dintérêt pour stimuler

la mobilisation de lépargne - Taux de change compétitif pour favoriser le

dynamisme des exportations et limiter les

importations aux produits pour lesquels

lindustrie nationale nest pas compétitive - Libéralisation commerciale

- Ouverture aux IDE (sans libéralisation nécessaire

du compte de capital de la balance des

paiements) - Privatisation

- Dérégulation

- Réforme du droit de la propriété destinée à

encourager lintégration de léconomie

informelle.

52

Lécole critique anti-libérale

- Marx et ses descendants

- LEcole de la Dépendance Baran Sweezie, Samir

Amin, Immanuel Wallerstein, A. Gunder Frank - Les dissidents Krugman, Sachs, Stiglitz

53

Marxist approach to economic development

- Developments ingredients?

- ? Capital accumulation labor exploitation to

generate surplus value and profits! - ? Overall revenue is based on the economic value

stemming from C, V and PL. Over the long term,

there is a declining trend in V vs C, due to

technology progress and on-going capital

investment.

54

Karl Marx (1818-1883)

- Born in Trier, Prussia in 1818. Doctorate in

philosophy at the age of 23. Early work

influenced by David Ricardo and Adam Smith. - 1848 (co-written with Friedrich Engels), "The

Communist Manifesto - History is a series of class struggles between

the owners of capital and the workers. - An inevitable consequence of the capitalist

system is an ever-increasing concentration of

wealth in the hands of a few of the owners of

capital, which at some critical point will lead

to a revolution and from this, there will exist a

classless society. - In Das Kapital" Marx highlights the four stages

which societies pass through - feudalism, capitalism, socialism,

and communism.

55

Capitalism a contradiction-driven engine of

growth and crisis

- After years of scholarly research (in the British

Museum Reading Room), Das Kapital was published

in 1867. Engels edited the further two volumes

which were issued posthumously in 1885 and 1894. - Marx offers his economic interpretation of

history and the theory of class struggle. - Capitalism is a form of social order that

contains its own inherent contradictions. - Labor theory of value Exploitation and

alienation of the worker Falling rate of profit

inevitable crisis, leading to revolution and

eventually to the socialist state.

56

Marxist approach to economic development

- World capitalism is doomed to systemic crises due

to several internal contradictions - 1. The contradiction between labor exploitation

and the need for stimulating consumption leads to

overproduction crisis, - 2. Competition for profits leads to ever

extending the capitalist system into developing

economies where labor is cheaper, hence long-term

diminishing trend in profits - 3. Keen competition between multinational

companies gradually erode the dynamic stimulus of

competition and leads to monopolies for the

sharing of markets worldwide.

57

Marxist approach to economic development

- Overall Revenue Y C W PL

- Profit rate PL/Y PL 1

C Constant Capital W Wages PL Surplus value

C W

Ratio of capital vs manpower

PL/W

C/W 1

Profit coming from labor exploitation

? Law of declining trend in capitalism profit

rate

58

The gloom approach

- Rosa Luxembourg (1871-1919)

- German revolutionary leader, journalist, and

socialist theorist, who was killed in Berlin in

1919 during the German revolution. Only socialism

could bring true freedom and social justice. - Luxemburg was the advocate of mass action,

spontaneity, and workers democracy. - In 1912 appeared her major theoretical work, The

Accumulation of Capital, in which she tried to

prove that capitalism was doomed and would

inevitably collapse on economic grounds.

59

Marxs comeback

- Joan Robinson (1903-1983), "one of the leading

unorthodox economists of the 20th century .

Robinson incarnated the "Cambridge School . She

traveled extensively, especially to India and

China. - The Accumulation of Capital (1956) extends

Keynes's theory to account for long-run issues of

growth and capital accumulation. - Strong sense of the historical context of social

change and concern with the challenge of stable

and shared economic development . - Robinson's 1942 Essay on Marxian Economics

proved insightful, critical and among the first

studies to take Marx seriously as an economist.

60

Marx s grandsons Dependency Approach

- Economic developments roots of industrialized

countries? - ? Center-periphery interactions with massive

exploitation of cheap labor and abundant raw

materials in under-developed countries. - WHO?

- Wallerstein, Baran, Sweezie, Samir Amin, Palloix,

Gunder Franck... (The Capitalist World-Economy)

61

Dependency Approach

- The only kind of social system is a world system,

defined as a unit with a single division of labor

and multiple cultural systems. - The capitalist world-economy emerged in the

mid-XVI century and spread over the entire

world. It is characterized by a situation of

structural dependence of developing countries

under the domination of center-country

economies. - The capitalist world-economys objective is

production for sale in a market in which the aim

is to realize the maximum profit. In such a

system, production is constantly expanded as long

as further production is profitable.

62

Dependency Approach

- Engine of growth capitalism is the only mode of

production in which the maximization of profit

creation is rewarded per se. The rewards and

penalties are mediated through a structure

called the market, that is the principal arena

of economic power struggle. Thus the pressure is

for constant expansion. - The world capitalist system involves not only

appropriation of the surplus value by an owner

from a worker, but an appropriation of surplus of

the whole world-economy by core areas (Britain in

the XIX century, USA and industrialized

countries in the XX and XXI centuries).

63

Dependency Approach

- Engine of growth and crisis? The ability of the

system as a whole to expand and create more

profit regularly runs into the bottleneck of

inadequate world demand crisis of

overproduction, stock market crisis, deflation - The role of the state as an institution in the

world-economy is to regulate the market, i.e., to

monitor the freedom of the market to minimize the

risk of crisis. - The world economy does not tolerate any

socialist systems because it is rooted in a

single world system, capitalist in form.

64

Dependency Approach

CORE

PERIPHERY

PERIPHERY

PERIPHERY

65

Simon Kuznets (Nobel Prize 1971)

- Growth long-term rise in capacity to supply

increasingly diverse economic goods, based on

advancing technology, and the institutional and

ideological adjustments that it demands.

66

Simon Kuznets

- Characteristics of modern growth

- High rates of growth of per capita product

- Rise in the rate of productivity

- High rate of structural transformation

- Change in social and ideological structures

- Globalization of technological and capital flows

- Large income gap between developed and emerging

countries

67

Les DISSIDENTS

- K. Polyani

- Krugman

- Stiglitz

- Sachs

- Bourdieu

- Foucault

- Stiegler

68

Karl Polanyi (1886-1964) I

- Remise en cause du rôle du marché, dans une

perspective historique (La Grande

Transformation) le marché nest ni naturel, ni

éternel. Sous sa forme capitaliste, il est même

récent. - Son émergence est la conséquence dune

intervention consciente et souvent violente de

lÉtat, qui a imposé lorganisation du marché à

la société. - Le marché autorégulateur du XIXe siècle repose

sur légoïsme économique pour assurer sa

régulation. - La révolution industrielle a créé un

bouleversement social et technique avec une

amélioration sans précédent des instruments de

production, accompagnée dune dislocation du

système social dans le marché autorégulateur.

69

Karl Polanyi (1886-1964) II

- Le marché réduit lhomme et la nature à de

simples marchandises. Il est la matrice du

système économique et social au XIXe siècle quand

le libéralisme économique simpose dans une

croisade passionnée et que le laissez

faire devient foi militante. - Ce marché, fondé sur le travail concurrentiel, le

mécanisme dajustement automatique de létalon-or

et le libre-échange international, est aussi

utopique que destructeur. Il est si totalitaire

quil ne peut résister longtemps à la rébellion

sociale quil attise.

70

Paul Krugmans view on economic crisis

Born in 1953 Ph.D. in 1977 from MIT. In 1982-3,

he worked at the White House for the Council of

Economic Advisors. Received the prestigious John

Bates Clark Medal in 1991. Currently at

Princeton. Krugman's main focus in economics has

been on international trade. New trade theory

deals with the "consequences of increasing

returns and imperfect competition for

international trade."

71

Paul Krugmans view on globalization

- In the 1980s, openness to trade was widely

believed to reduce the likelihood of financial

crises. - Today, growing global integration does predispose

the world economy toward more crises because it

creates pressures on governments to relax

restrictions. - Economies are doing better in good times but are

far more vulnerable to sudden crises due to rapid

capital flight. The ride will continue to be very

bumpy for many years to come!

72

Krugmans view on Asias 1997-98 economic crisis

- The logic of catastrophe was pretty much the

same in Thailand, Malaysia, Indonesia and South

Korea. (Japan is a very different story.) In each

case investors--mainly, but not entirely, foreign

banks who had made short-term loans--all tried to

pull their money out at the same time. - The result was a combined crisis

- a banking crisis because no bank can convert all

its assets into cash on short notice - a currency crisis because panicked investors were

trying to convert baht or rupiah into dollars. - a governance crisis

73

Paul Krugmans view on Asias crisis

Was the crisis a punishment for bad economic

management? Like most clichés, the catchphrase

"crony capitalism" underlies something real

excessively cozy relationships between government

and business really did lead to a lot of bad

investments. The still primitive financial

structure of Asian business--too little equity,

too much debt and too much of that debt

consisting of soft loans from accommodating

banks--also made the economies peculiarly

vulnerable to a loss of confidence

74

Joseph Stiglitzs views

75

Core ideas

- Poverty is an affront to human dignity

- G7 governments urge liberalization on developing

countries while maintaining trade restrictions

and pushing intellectual property protection into

the WTO. - The IMF's policies are based on the outworn

presumption that markets, by themselves, lead to

efficient outcomes, and do NOT allow for

desirable government interventions. - Asymmetries of information prevent markets from

full efficiency. Government and market are

complementary and there is an important role, if

limited, for government to play.

76

What is asymmetry of information?

- It is the difference in information between two

economic agents within an economic relation

(e.g. the worker and his employer, the lender

and the borrower, the insurance company and the

insured ) - According to Stiglitz, financial markets cannot

regulate themselves because anyone has NOT the

same information at the same moment. Therefore

the aim is to find the best structure to regulate

markets (and not to let them work by themselves).

77

Consequences

- Deregulation will not promote financial

development when information is asymmetric and

competition inadequate. The economic efficiency

is not secured. It will spur corruption and

create an oligarchic elite that opposes the

emergence of competitive markets. - The partisans of the Washington consensus

overlooked the importance of economic and

corporate governance, underestimate the

difficulty of building institutions, and forgot

that many countries lack the sophisticated public

administrations needed to ensure adequate

competition.

78

The challenge of the IMF

- Increased transparency at the IMF is essential.

Decisions there are made on the basis of ideology

and bad economics. When crises hit, the IMF

prescribes outmoded, inappropriate, if standard

solutions, without considering the effects they

would have on the people in the countries told to

follow these policies. - No discussions of the consequences of alternative

policies. Ideology guides policy prescription..

79

Jeffrey Sachs views

- Director of the Center for International

Development and professor of international trade

at Harvard University - Economic advisor for the government of Poland in

1990 and for Russia's President Boris Yeltsin

from 1991 to 1994 "shock therapy" to create

market capitalism in Russia - Special Adviser to the UNs General Secretary

80

Sachs The situation in Asia

- There vas no fundamental reason for Asia s

financial calamity - Budgets were in balance or surplus

- Low inflation

- High private savings rates

- Economics were poised for export growth

- The IMFs tough macro-economic conditionality for

approving financial support led to recessionary

monetary policy and increased panic

81

The Asian crisis an unpredictable crisis

- In Thailand currency overvalued overcapacity

in real estate - Bath devaluation required in 1997

- Overstated financial panic of the investors in

Asian countries domino effect - Flight of capital in an opposite flow

- Asian countries needed really significant

financial sector reform - But not sufficient cause for panic and for harsh

macroeconomic policy adjustments

82

IMF declarations

- Before the Asian crisis (April 1997)

- Directors welcomed Koreas continued impressive

macroeconomic performance and praised the

authorities for their enviable fiscal record - Directors strongly praised Thailands

remarkable economic performance and the

authorities consistent record of sound

macroeconomic policies - IMF, 1997 annual report

83

LÉcole Française

- Braudel

- Aron

- Foucault

- Bourdieu

- Stiegler

84

La France et les fondements culturels de

lopposition au libéralisme économique

- Tradition anti-libérale Opposition de léglise

catholique au marché et au prêt à intérêt

(Nicée-325) en sappuyant sur les doctrines

dAristote et de St Thomas dAquin (production

suffisante pour la survie et tout échange à titre

commercial est stérile et superflu) - A lopposé, lAngleterre sappuie sur les

échanges commerciaux et financiers (Réforme

introduite par Henri VIII) - Fronde des économistes libéraux Mirabeau,

Quesnay, Turgot, et Say, contre les

mercantilistes attachés à accumuler la richesse

monétaire, les Physiocrates qui sacralisent la

terre, et les colbertistes qui demandent

lintervention de lEtat. - Appui libéral de Turgot (1774) libre-échange,

suppression des corporations, libération du

commerce des viandes et des grains

85

Globalisation et démocratie convergence ou

antagonisme?

- Globalisation et contrôle de linformation et de

la transmission de la connaissance menace contre

la démocratie? - La diffusion de la connaissance a une fonction

civique clé, elle est au cœur de la nouvelle

citoyenneté globale au moment où le monopole de

la diffusion de linformation na jamais été

aussi fort (malgré lillusion dune culture

globale te décentralisée via Internet!) - La question de la représentation de la société

civile au niveau national et international se

pose de façon plus aigue dans la globalisation

jusquaux années 1960, les médiations étaient

organisées sous légide des états partis,

syndicats, organismes inter-nationaux

Aujourd'hui, besoin de contre-pouvoirs par la

prise de parole de mouvements représentatifs

autoproclamés (ONGs, associations, groupes de

pression) qui refusent de voir en lEtat et dans

la démocratie représentative les seuls lieux de

débats démocratiques. - Une démocratie ne vit que de contre-pouvoirs

équilibre toujours instable. Enjeu à la défiance

libérale pour toujours limiter le pouvoir et à la

défiance marxiste-keynésienne du marché pour

maintenir une fonction de régulation centralisée,

nouvel espace pour une vigilance citoyenne par de

nouvelles médiations de type associatif?

86

Fernand Braudel (1902-1985)

- Civilization and Capitalism (1955-1979)

- Stages in the development of

- capitalism since the 15Th century

- Dans le long-terme, le capitalisme acquiert un

tropisme mondial et sétend à toute activité de

production et déchange de biens et services - Braudel analyse les tendances de long-terme

tandis que Nicolaï Kondratieff en 1922 étudie

les cycles longs (50 ans) - Schumpeter en 1939 explore le rôle moteur de

linnovation et des ruptures technologiques au

sein des cycles

87

Braudel et la dimension historique du marché

- Fernand Braudel (1902-1985) analyse lémergence

du rôle du marché capitaliste avec lintervention

des grands négociants qui simposent sur le

marché en court-circuitant le jeu de la libre

concurrence.

Le marché est le lieu dun rapport de force et le

capitalisme perpétue les hiérarchies et les

inégalités des systèmes sociaux qui lont

précédé. À la fin du Moyen-Âge, la petite élite

des marchands capitalistes a su utiliser à son

profit ses relations privilégiées avec les

gouvernants Le capitalisme ne triomphe que

lorsquil sidentifie avec lÉtat, quil est

lÉtat . Le capitalisme ne peut apparaître et

prospérer quadossé au pouvoir.

88

Raymond Aron et la mondialisation (1)

- Aron réfute le concept dimpérialisme économique

fondé sur la relation antagoniste centre

périphérie qui suppose la prédominance causale

du système économique sur les rapports

interétatiques.

- Lexploitation impérialiste des ressources des

pays en développement date du XIX siècle et, au

plus, du début du XX. De plus, le lobby des EMNs

nest pas toujours en phase avec les objectifs

géopolitiques des Etats de lOCDE et ces

conglomérats ne partagent pas les mêmes intérêts

et sont soumis à des pressions concurrentielles

trop fortes pour décider dun partage du monde et

dune mise en coupe réglée des pays en

développement. - Enfin, les pays, développés ou non, ont davantage

profité des IDE américains, européens ou

japonais, quils nen ont soufferts transferts

financiers, technologie, management, pourvoyeurs

demplois et de ressources dexportations

Raymond Aron Les dernières années du siècle,

Julliard, Paris 1984.

89

Raymond Aron et la mondialisation (2)

- Le déclin des Etats nationaux et leffacement des

frontières nempêchent pas le modèle étatique

européen de simposer dans un nombre croissant de

pays en Europe de lEst ou en Afrique, notamment,

avec une souveraineté reconnue et la création

dune société civile - lEtat national reste une priorité, même si le

système économique échappe de plus en plus au

système interétatique et devient transnational.

90

Michel Foucault (1926-1984) Naissance et essor

du libéralisme I-

1. La doctrine monétariste des mercantilistes

dans le cadre de létalon-or suppose un rôle clé

de lEtat pour limiter la concurrence, tandis que

Smith apporte au XVIII siècle une théorie du

moindre Etat avec la prédominance de la

régulation par le libre marché le jeu de la

concurrence produit un gain pour toutes les

parties doctrine de lenrichissement mutuel.

2. Lhomo economicus dAdam Smith ne vise que la

maximisation de son gain propre et la main

invisible du marché combine et harmonise les

comportements égoïstes individuels pour les faire

converger vers lintérêt collectif reste dune

pensée théologique de lordre naturel opacité

individuelle /transparence collective 3. La main

dAdam Smith est une sorte de providence

harmonieuse et la notion dinvisibilité est

essentielle car le bien collectif ne peut et ne

doit être visé par les agents économiques dont le

comportement reste aveugle à lintérêt général.

4. Lhomo economicus est le seul îlot de

rationalité possible au sein du processus

économique qui est par nature opaque et non

totalisable. 5. Impossibilité de lexistence

dun souverain économique!

91

Michel Foucault- Naissance et essor du

libéralisme -II-

- LEtat et le pouvoir politique ne doivent donc

pas intervenir laissez-faire - Le libéralisme est porté par le principe on

gouverne toujours trop - Léconomie est une discipline sans Dieu et ni

souverain le domaine de ce dernier reste

circonscrit au politico-juridique lEtat régule! - Organisation dun marché mondial par les Etats

droit de la mer, traités de paix (Kant en 1795 et

son projet de paix universelle et perpétuelle

fondée sur léchange et la propriété), traité de

Vienne de 1815 avec instauration dun équilibre

européen interétatique, organisations

internationales

92

Michel Foucault- Naissance et essor du

libéralisme -III-

- Avec lémergence du libéralisme au XVIII, il

revient à lEtat dorganiser la liberté. Le

système libéral produit et régule la liberté,

dans léquilibre des intérêts individuels et des

intérêts collectifs liberté/sécurité impose

contrôle et réglementations. - LEtat a pour fonction principale de définir et

de garantir le libre jeu du marché concurrentiel,

source de croissance et de progrès. Sur la base

de règles qui sappliquent à tous, ce jeu permet

des prises de décision décentralisées

93

Michel Foucault- Naissance et essor du

libéralisme IV-

- Le néolibéralisme américain se propose de

généraliser la forme économique du marché et de

létendre à toute forme dactivité de production

et déchange de biens et services - Extension du principe dutilité marginale et de

transaction à lensemble du corps social et

concept de capital humain un ménage est une

unité de production avec lengagement contractuel

de deux parties à fournir des inputs spécifiques

et à partager dans des proportions données les

bénéfices de loutput ce contrat reflète un

intérêt commun à minimiser les coûts de

transaction - Application de lanalyse coût/bénéfice à

lintervention publique dans le champ

socio-économique American Enterprise Institute

le pouvoir politique est toujours en excès!

94

Pierre Bourdieu (1930-2002)

Critique du postulat de rationalité du marché

À la suite de Polanyi, refus de reconnaître la

suprématie du marché, ordre soi-disant naturel,

qui doit assurer un équilibre stable et le moyen

optimal dallocation équitable des ressources.

Pierre Bourdieu, Charles-Albert Michalet ou

Bernard Maris remettent en question cette

domination, trop souvent prise pour acquis dans

une totale abstraction historique et

institutionnelle.

- Selon Bourdieu, le discours sur le marché est

imprégné didéologie - Il mime une rationalité scientifique alors quil

est dabord politique. - Il reflète la pensée dominante américaine, bien

quil se pense et se donne comme universel. - Il repose sur une abstraction originaire qui

consiste à dissocier une catégorie particulière

de pratiques (léconomie) de lordre social - Léconomie se veut un domaine séparé gouverné par

des lois naturelles et universelles que les

gouvernements ne doivent pas contrarier par des

interventions intempestives.

95

Bourdieu le marché, rhétorique et métaphore

- Il ny a plus dalternative puisque le monde

bipolaire a vécu et que toute nation moderne se

doit demprunter le chemin déjà parcouru par les

États-Unis qui montrent la voie du progrès ! - La mondialisation a pour effet dhabiller

dœcuménisme culturel ou de fatalisme économiste

les effets de limpérialisme américain et de

faire apparaître un rapport de force

transnational comme une nécessité naturelle - La mondialisation prétendument inévitable est

moins une nouvelle phase du capitalisme quune

rhétorique quinvoquent les gouvernements

pour justifier leur soumission volontaire aux

marchés financiers. - Le nouvel ordre impose sa domination à laide de

plusieurs leviers simultanés qui, tous, reflètent

un rapport de force socioéconomique et culturel.

96

Bourdieu le marché, rhétorique et métaphore

- Limpérialisme américain apparaît autant dans le

pouvoir des sociétés multinationales que dans

cette novlangue , qui diffuse une nouvelle

vulgate planétaire centrée sur le marché. - Limpérialisme culturel est ainsi une violence

symbolique qui sappuie sur une relation de

communication contrainte pour extorquer la

soumission. Il véhicule sous une apparence

technique et objective des notions a priori

dépourvues de contenu politique en masquant leurs

racines historiques. - Cette colonisation mentale constitue en modèle la

société américaine elle promeut les valeurs de

marché et de profit comme les horizons

indépassables de notre temps Une nouvelle

rationalité comme fatalité quil faut embrasser

sous peine darchaïsme!

97

Globalisation et contrôle culturel Bernard

Stiegler

- Le capitalisme devenant culturel, la culture

devient elle-même la clé de toute domination

socio-économique triomphe du consumérisme. Le

contrôle culturel est au cœur du processus de

domination du capitalisme américain. - La puissance américaine réside dans sa capacité à

linnovation permanente pour produire des

symboles nouveaux autour desquels se forment des

modèles de vie massification des comportements,

hypersynchronisation et standardisation. - Chaque fois que se produit une rupture

technologique majeure, lEtat est au coeur du

processus dadaptation socio-économique. Aux USA,

dynamisme social moins par partage dun passé

commun que par projection dun désir davenir

unificateur.

Source Mécréances et Discrédit

98

Globalisation et contrôle culturel Bernard

Stiegler

- Le monde actuel vit une immense contradiction

les problèmes à long terme, exprimant des

tendances lourdes, se profilent et saccumulent,

tandis que les fonctionnements économiques sont

désormais massivement dominés par des logiques à

très court terme. Devenu financier, le

capitalisme ne privilégie plus les cohérences

économiques et industrielles, mais les retours

sur investissement les plus rapides possibles. - Dautre part, lindustrie vit de grandes

mutations technologiques, qui nécessitent

précisément des capacités danticipation et de

transformations structurelles, et qui doivent

être accompagnées et soutenues par une puissance

publique réinventée, alors que l monde politique

ne tient aucun discours sérieux ni sur ces

contradictions, ni sur le rôle de la puissance

publique en ces matières.

Source Ars Industrialis 09/06

99

Globalisation et contrôle culturel Bernard

Stiegler

- Cest dans ce contexte que la démocratie est

détruite par la télécratie. - Remplaçant lopinion publique par le marché des

audiences, la télécratie est devenue le principal

facteur de limpuissance politique, dont le signe

le plus massif est le renoncement à tenir un

véritable discours sur le long terme la

télécratie fait à la démocratie ce que le

capitalisme financier fait au capitalisme

industriel. - Une puissance publique repensée doit porter une

nouvelle politique industrielle où la place dans

le devenir politique et économique des

technologies culturelles et cognitives, et avec

elles des médias audiovisuels, sont devenus

lélément clé de tout le système les

technologies de lesprit nécessitent de repenser

la société industrielle dans ses axiomes mêmes.