Evaluation Alternatives Present Worth Analysis - PowerPoint PPT Presentation

Title:

Evaluation Alternatives Present Worth Analysis

Description:

Evaluation Alternatives Present Worth Analysis – PowerPoint PPT presentation

Number of Views:143

Avg rating:3.0/5.0

Title: Evaluation Alternatives Present Worth Analysis

1

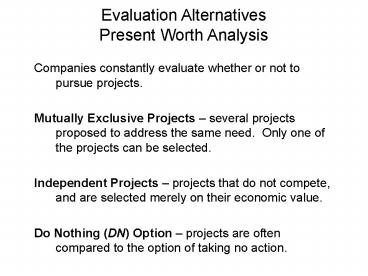

Evaluation AlternativesPresent Worth Analysis

- Companies constantly evaluate whether or not to

pursue projects. - Mutually Exclusive Projects several projects

proposed to address the same need. Only one of

the projects can be selected. - Independent Projects projects that do not

compete, and are selected merely on their

economic value. - Do Nothing (DN) Option projects are often

compared to the option of taking no action.

2

Present Worth Analysis

- Project Types

- Revenue each alternative project being

evaluated generate costs and revenues. These

alternatives usually involve the purchase of new

systems and equipment in order to increase

revenue. Both the cost streams and revenue

streams vary by alternative. - Service Each alternative has only cost cash

flow estimates. These projects are typically for

safety, or are government mandated projects.

3

Present Worth Analysis Equal Life Alternatives

- One alternative Calculate the present worth

(PW) at the MARR. If PW gt 0, the requested MARR

is met or exceeded and the alternative is

financially viable. - Two or more alternatives calculate the PW of

each alternative at the MARR. Select the

alternative with the PW value that is numerically

largest. (If all PW are negative, and do nothing

is an alternative, then do nothing.)

4

Present Worth Analysis Equal Life Alternatives

- Revenue Example You are evaluating the purchase

of a two income properties. You expect a MARR of

15. You have enough funds for both purchases. - 75K Home 37.5K Home

- Purchase Price 15,000 7,500

- Annual Maint. 6,000 4,000

- Annual Income 7,500 5,000

- Resale (after

- Expenses) 90,000 40,000

- Life, years 15 15

5

Present Worth Analysis Equal Life Alternatives

- 75K Home

- PW -15,000 1500(P/A,15,15)

90,000(P/F,15,15) - PW 4832

- 37.5K Home

- PW -7,500 1000(P/A, 15,15)

40,000(P/F,15,15) - PW 3263

- What if 8 MARR was used?

- PW (75K Home) 26,207

- PW (37.5K Home) 13,667

6

Present Worth Analysis Equal Life Alternatives

- Service Example You are evaluating the purchase

of a new or used car that needs to last you for

only 5 years. - New Car Used Car

- Purchase Price 20,000 10,000

- Annual Maint. 500 1,000

- Resale Value 8,000 4,000

- Life, years 5 5

7

Present Worth Analysis Equal Life Alternatives

- Use 8 for i since 8 is the expected rate of

return if money invested in stock market rather

than purchasing a vehicle. - New Car

- PW -20,000 - 500(P/A,8,5) 8000(P/F,8,5)

- PW -16,552

- Used Car

- PW -10,000 -1000(P/A,8,5) 4,000(P/F,8,5)

- PW -11,270

8

Present Worth Analysis Different Life

Alternatives

- The Present Worth of alternatives must be

compared over the same number of years. - If project alternative have different service

lives, the equal service requirement can be

satisfied by - Compare the alternative over a period of time

equal to the least common multiple (LCM) of their

lives. - Compare the alternative using a study period of

length n, which does not necessarily take into

consideration the useful lives of the

alternatives. This period n is called the

planning horizon.

9

Present Worth Analysis Different Life

Alternatives

- Revenue Example You are evaluating the upgrade

of some production equipment to increase

productivity. You are considering two

alternatives. Company policy dictates a MARR of

20. - Alternative 1 Alternative 2

- Purchase Price 200,000 100,000

- Annual Maint. 5,000 2,000

- Productivity Imp.

- (per year) 40,000 20,000

- Life, years 10 12

10

Present Worth Analysis Different Life

Alternatives

- Revenue Example Because life alternatives are

different, you decide to use a 10 year planning

horizon and estimate a resale value of

alternative of 5000 for the remaining 2 year of

life. - Alternative 1

- PW -200,000 35,000(P/A,20,10)

- PW -53,262

- Alternative 2

- PW -100,000 18,000(P/A,20,10)

5000(P/F,20,10) - PW -23,727

- Which alternative should you choose?

- Do nothing.

11

Present Worth Analysis Different Life

Alternatives

- Service Example You are evaluating the purchase

of a new or used cars that needs to last you for

10 years. - New Car Used Car

- Purchase Price 20,000 10,000

- Annual Maint. 750 1,000

- Resale Value 4,000 4,000

- Life, years 10 5

12

Present Worth Analysis Different Life

Alternatives

- Use 8 for i since 8 is the expected rate of

return if money invested in stock market rather

than purchasing a vehicle. - New Car

- PW -20,000 - 750(P/A,8,10)

4000(P/F,8,10) - PW -23,180

- Used Car

- Buy used car in year 0 Buy

used car in year 5 - Sell car in year 5

- PW -10,000 4,000(P/F,8,5)

-10,000(P/F,8,5) 4000(P/F,8,10)

-1000(P/A,8,10) - PW -18,941

13

Future Worth Analysis

- Future worth analysis is similar to present worth

analysis, expect that all cash flows are

normalized to some future point in time. - Future worth is often used if an asset is to be

sold at some future point in time, but before its

expected life is reached. The future worth would

be an indicator of how much the asset could be

sold for at that future point in time (of course

this assumes the buyer expects the same cash

flows you anticipate).

14

Future Worth Analysis

- Example A company is considering selling off its

power generation plants in 5 years. The cash

flow projection over the next 5 years for this

power generation operation unit is depicted

below. What sales price in year 5 (future

worth)must be received to achieve the companys

ROR of 15 per year. - FW -60(F/P,15,4) 25(F/P,15,3)

50(F/P,15,2) 75(F/P,15,1) 50

FW

75

50

50

25

0 1 2 3 4 5 6 7

8

60

15

Capitalized Cost

- Capitalized cost (CC) is the present worth of an

alternative that will last forever. Examples

include University endowments, and large public

sector projects (dams, bridges, tollroads, etc.). - CC is related to P/A formula

- P A(P/A,i,inf.)

- As n approaches infinity, CC A/i.

- This result should make common sense. For

example if an endowment was invested at 10

interest, and 1000 was to be withdrawn every

year indefinitely, then 1000/.1 10,000 must

be the present amount in the endowment.

16

Capitalized Cost

- The following examples demonstrates how to obtain

the capitalized cost of an asset which contains

both recurrent and non-recurrent cash flows. - A toll-road was just completed at a cost of 1.5

billion, with major maintenance expenditures of

500 million forecast every 10 years. Annual

receipts minus maintenance results in a positive

cash flow of 150 million. What is the present

worth, assuming i 5?

150

150

0 1 2 3 4 5 6 7

8 9 10 11 20

500

1500

17

Capitalized Cost

150

150

150

0 1 2 3 4 5 6 7

8 9 10 11 20 ..

500

1500

- 1) Distribute the 500million every 10 years to

an annual cost. - A1 -500(A/F, 5,10) -39.75 million.

- Therefore AT 110.25 million.

- 2) CC -1,500 110.25/.05 705 million

18

Payback Period Analysis

- The payback period, np, is the estimated time,

usually in years, it will take for the estimated

revenues and other economic benefits to recover

the initial investment and a stated rate of

return i. - In other words, find np that satisfies the

following equation - Or if all end of year cash flows are equal,

- where NCF is the net cash flow in period t, and

DP is the initial downpayment or cash flow at

time 0

19

Payback Period Analysis

- Example A pharmaceutical company anticipates

RD cost of 1.5 Billion for the development of a

new drug. In addition, production startup costs

are estimated at 1.0 Billion. Annual marketing

costs are expected to be 50 million, annual

production costs are 100 million, and annual

sales are expected to be 500 million. What is

the payback period for an ROR of 10? - DP 2,500 Million

- A 350 million

- 2,500 350(P/A, 10,n)

- (P/A,10,n) 7.14

- n 13.1

20

Payback Period Analysis

- Caution Payback period does not necessarily

indicate one alternative being preferable to

another alternative. - Example Using ROR of 15

- Machine 1 Machine 2

- DP 12,000 8,000

- Annual

- NCF 3000 1000 (year 1-5)

- 3000 (year 6-14)

- Max Life 7 14

- (years)

21

Payback Period Analysis

- Example

- Machine 1 0 -12,000 3000(P/A,15,np)

- np 6.57

- Machine 2 0 -8,000 1000(P/A,15,5)

- 3,000(P/A,15,np-5)(P/F,15,5)

- np 9.52

- Using LCM of 14 years.

- PW 1 -12,000 - 12,000(P/F,15,7)

3000(P/A,15,14) 663 - PW 2 -8,000 1000(P/A,15,5)

3000(P/A,15,9)(P/F,15,5) - 2470

22

Life Cycle Cost (LCC)

- LCC analysis is the present worth (PW) of an

alternative at a stated MARR, covering all costs

from the early stages of design through the final

stages of phase-out and disposal. - Example A pharmaceutical company anticipates

RD cost of 1.5 Billion for the development of a

new drug. In addition, production startup costs

are estimated at 1.0 Billion. Annual marketing

costs are expected to be 50 million, annual

production costs are 100 million, and annual

sales are expected to be 500 million. At the

end of production, the plant and equipment can be

sold for 100 million. This drug is to be phased

out after 20 years. What is the LCC assuming a

10 MARR.

23

Life Cycle Cost (LCC)

- Example A pharmaceutical company anticipates

RD cost of 1.5 Billion for the development of a

new drug (in years 12). In addition, production

startup costs are estimated at 1.0 Billion (in

year 34). Annual marketing costs are expected

to be 50 million, annual production costs are

100 million (both starting in year 5). At the

end of production, the plant and equipment can be

sold for 100 million (year 24). This drug is to

be phased out after 20 years of production. What

is the LCC assuming a 10 MARR. - (in millions)

- PW 750(P/F,10,1) 750(P/F,10,2)

500(P/F,10,3) 500(P/F,10,4)

150(P/A,10,20)(P/F,10,4) - 100(P/F,10,24)

24

Present Worth of Bonds

- Bonds are financial instruments for raising

capital. In other words, in order to finance

major projects, the government or corporations

issue bonds in return for cash. - The borrower (corporation) promises to pay the

face value of the bond upon maturity (V), and

agrees to pay interest or dividends (I) at

periodic times. Expected dividend payments are

quarterly or semi-annually (c 4 or 2). The

Interest is determined using the stated bond

coupon rate (b).

25

Present Worth of Bonds

- Example To find the interest payment on a 1000

US treasury bond stated as paying 5 quarterly. - V 1000

- b 5

- c 4

- Therefore I 1000(.05)/4 12.5 per quarter

26

Present Worth of Bonds

- How much should you purchase a bond for (PW)?

- To find the present worth (to you) of a bond,

perform the following - Determine I, the interest per payment period.

- Construct the cash flow diagram, including the

dividend payments and the face value payment upon

maturity. - Establish a MARR.

- Calculate PW.

27

Present Worth of Bonds

- Example Find the PW on a 1000 US treasury bond

stated as paying 5 quarterly with a maturity

date 10 years from now. Assume a MARR of 12,

compounded quarterly. - I 1000(.05)/4 12.5 per quarter.

- n 104 40 quarters.

- i 12/4 3

- PW 12.5(P/A,3,40) 1000(P/F,3,40)

595.54