Lecture IIIB2: Financial Leverage and Capital Structure Policy Ch. 16 PowerPoint PPT Presentation

1 / 37

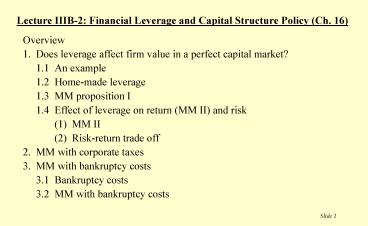

Title: Lecture IIIB2: Financial Leverage and Capital Structure Policy Ch. 16

1

Lecture IIIB-2 Financial Leverage and Capital

Structure Policy (Ch. 16)

- Overview

- 1. Does leverage affect firm value in a perfect

capital market? - 1.1 An example

- 1.2 Home-made leverage

- 1.3 MM proposition I

- 1.4 Effect of leverage on return (MM II) and

risk - (1) MM II

- (2) Risk-return trade off

- 2. MM with corporate taxes

- 3. MM with bankruptcy costs

- 3.1 Bankruptcy costs

- 3.2 MM with bankruptcy costs

2

Overview

- For the discussion of cost of capital, we take

the capital structure of a firm as given. Now we

look at the effect of capital structure on the

firms value. - Capital structure policy refers to a decision on

the mix of debt and equity for a given asset

size. Our goal is to find out an optimal capital

structure of a firm. - Major results are Modigliani and Miller (MM)

propositions I and II.

3

1. Does leverage affect firm value in a perfect

capital market?

- 1.1 An Example

- The ABC (Amazing Brew Coffee) Company is

reviewing its capital structure. - Assume no taxes and a perfect capital market.

- The company has no debt.

- All operating income is paid out as dividends.

- Its current position is as follows

4

1.1 An example.. Table 1 current structure

- Mr. Modigliani, the firm's president, proposes

to issue 1,000 of debt at 10 and use the

proceeds to repurchase 50 shares. His analysis

follows.

5

1.1 An example.. Table 2 Proposed structure

6

1.1 An example..Figure 1 Financial leverage,

EPS and EBIT

7

1.1 An example.. some conclusions from Figure 1

- Let us draw some conclusions from Figure 1.

- The effect of financial leverage depends on ABCs

EBIT. At a high level of EBIT, leverage is

beneficial. - Under the expected scenario (i.e., state 2),

leverage increases ROE and EPS. - Shareholders, however, are exposed to more risk

under the proposed capital structure since the

ROE and EPS are more variable and sensitive to

changes in EBIT.

8

1.1 An example.. Mr. Modiglianis argument

- Mr. Jack Modiglianis argument

- Since we expect operating income to be 250

which is above the critical level of 200, the

shareholders will be better off with levered

capital structure. - Indifference EBIT Note from Figure 1 that EPS

(earnings per share) is 2 under current and

proposed capital structure when EBIT equals to

200. How do we find out the indifference

EBIT? - Let X denote EBIT. Under current structure,

EPS is simply X/100. Under the proposed

structure, you pay interest of 100, and there

are a total of 50 shares, so EPS is (X?100)/50.

Equate these two EPSs and solve for X gives

X200.

9

1.2 Home-made leverage

- Ms. Jane Millers counter-argument

- Leverage will help the shareholders as long as

operating income is above 200. But you ignore

the possibility of investors borrowing on their

own account. - Suppose that a person borrows 20 and puts up

20 of her own money. She then invests a total

of 40 in two unlevered ABC shares. - To see Ms. Jane Millers view, lets consider two

cases - Case 1 Proposed capital structure. Buy 1

levered share at 20 - Case 2 No change in capital structure. Borrow

20 use 20 of her own to buy 2 un-levered

shares

10

(No Transcript)

11

1.2 Home-made leverage

- Payoff from case 1 and case 2 are identical.

- Payoffs of 1 levered share is equal to the payoff

of the home-made portfolio of stock and

borrowing. - Value of 1 levered share Value of the portfolio

- The portfolio has 2 un-levered shares purchased

with 20 borrowing and 20 of your own money. - Value of 1 levered share (202 - 20

borrowing) 20 - ? Levered share price 20.

12

1.3 MM proposition I

- With perfect capital markets and no taxes, a

change in capital structure does not add any

value to the shareholders. - Formally, this is MM proposition I

- VU VL EL DL ,

- where,VU ? value of the unlevered firm

- VL ? value of the levered firm

- DL ? market value of equity

- EL ? market value of debt.

13

1.3 MM proposition I.. Unlevering the stock

- One more thing before we leave MM I.

- Example Unlevering the stock

- Suppose ABC adopts the proposed capital

structure. - Suppose that our investor prefers the original

(unlevered) capital structure. How can this

investor unlever the stock to re-create the

original payoffs? - Suppose she buys one levered share at 20 and

lends 20 at 10. - She receives earnings for 1 share and interest

from her 20 lending. - Her total payoffs are exactly same as the

original payoffs of two unlevered shares. (See

Table 5).

14

1.3 MM proposition I.. Unlevering the stock..

unlever the stock by buying one share and

lending 20

15

1.4 Effect of leverage on return (MM II) and risk

- (1) Leverage and equity returns MM II

- For our discussion of the cost of capital, we

have taken the firms capital structure as given. - We now look at how the cost of capital changes

with a change in capital structure. - Our goal to find out an optimal or target

capital structure, which maximizes the firm value

or equivalently minimizes the cost of capital. - We take the cost of debt as constant, at least,

initially. - In order to find out the WACC, we need to find

out the relation between return on equity and

capital structure.

16

1.4 (1) MM II

- Consider ABCs expected returns in two cases

(Table 6). - Intuitively, what is happening here?

In all-equity case, Jane earns 12.5 on her

2,000 equity. In levered case, she earns 12.5

on 1,000 equity, and additional 2.5 (i.e.,

12.5 - 10). Her total return on 1,000 equity

is 15 1,00012.5 1,000(12.5 -

10) 1,000 12.5 (1,000/1,000)(12.5

- 10)

17

1.4 (1) MM II..

- Suppose Jane puts only 500 equity and borrows

1,500 at 10. - From her 500 equity, she earns 12.5 return.

- From her 1,500 borrowings, she earns 2.5

(i.e., 12.5 - 10). - Total payoff on her 500 equity is

- 50012.5 1,500(12.5 - 10)

- 500 12.5 (1,500/500) (12.5 - 10)

- Total rate of return on her 500 equity is

- 12.5 (1,500/500) (12.5 - 10) or more

generally - RE RA (D/E)(RA - RD ), where RA return

on asset.

18

1.4 (1) MM II..

- Leverage and equity returns (another derivation

formal) - RA Expected operating income / Market value of

a firm - MM I says that capital structure does not affect

a firms value. So, RA is independent of its

debt decision. - A firm is a portfolio of debt (D) and equity (E).

So, RA is an weighted average of returns on

debt and equity. - Rearranging, we have MM II

19

1.4 (1) MM II..

- cost of capital

RE RA (RA - RD )(D/E)

WACC RA

RD

D/E

20

1.4 (1) MM II.. Another look at indifferece EBIT

What if Jane does not get any extra earnings from

debt? Then, in levered case, her return on equity

is equal to that in all-equity case. It is her

return on equity at indifference EBIT.

21

1.4 (1) MM II.. Another look at indifferece

EBIT..

- In out ABC example, borrowing rate is 10.

Total size of asset is 2,000. When RA10, ABC

makes 2,00010 200, which must be the

indifference EBIT.

22

1.4 (1) MM II.. Another look at indifferece

EBIT..

- Indifference EBIT based on ROE ROA (D/E)(ROA

- RD ). - At an indifference EBIT, the EPS of the levered

and unlevered share is identical. - Stock price still remains at 20 in our ABC

example. At indifference EBIT, EPS/Price is also

identical for levered and unlevered capital

structure. - Under an unlevered structure, EPS/Price ROE(All

E) ROA. - Under a levered structure, EPS/Price ROE

(Levered). - So at an indifference EBIT, ROE (Levered) ROA,

which implies ROA RD. - This makes sense. When ROA RD, Jane earns

only enough operating income to cover her

interest payment, and there is no beneficial

effect of leverage. Hence ROE (Levered) is same

as the ROE of all equity case, which is equal to

the ROA.

23

1.4 (2) Risk-Return trade-off

- MM I A firm's leverage does not affect its

value. - MM II return on equity increases as leverage

increases. - So, as leverage increases, the rate of return on

equity goes up, but the value of the firm stays

constant. How can they be reconciled? - What is happening is that risk is increasing as

leverage increases.

24

1.4 (2) Risk-Return trade-off..

- A firms beta is a weighted average of the betas

of debt and equity - ?A D/(DE)?D E/(DE)?E.

- Rearranging,

- ?E ?A (?A - ?D )(D/E).

- With 50 debt and 50 equity (D/E 1), ?D 0, we

have ?E 2?A. - Two components of risk in equity beta.

- Business risk ?A measures the riskiness of the

firms asset primarily arising from the nature of

the firms operation. - Financial risk ?A (D/E) depends on the firms

financial policy.

25

2. MM with corporate taxes

- Interest expenses are tax deductible. Debt

financing reduces tax bill, and thus has value.

To see this, let us compare two firms U and L.

They are identical except for a 200 debt at 10

for levered firm L. - Suppose corporate tax rate is 30. Then

relative to firm U, - Firm Ls taxable income goes down by the interest

expense. - Interest expense DRD 20010 20

- Firm Ls tax goes down by 20Tc 2030 6.

The tax saving due to interest expense is called

the interest tax shield. - Suppose this is a perpetual borrowing. Then PV

of the interest tax shield is 60. This is

6/0.1 (DRD) Tc / RD DTc.

26

2. MM with corporate taxes..

- So, the levered firm L is more valuable than

unlevered firm U by the PV of interest tax

shield, which equals to DTc for a perpetual

debt. - MM proposition I with corporate taxes VL VU

PV tax shield. - In the special case of permanent debt VL VU

Tc D, - where VL ? value of levered firm, and VU ? value

of all-equity firm. - MM's Proposition II with corporate taxes The

expected return on the common stock of a levered

firm increases in proportion to the D/E ratio and

(1?TC ) the rate of increase depends on the

spread between ? and RD . Formally, (? ? cost

of capital for unlevered firm),

27

2. MM with corporate taxes..

28

3. MM with bankruptcy costs

- Given MM results so far, what should firms do?

They should borrow as much as possible to gain

the maximum possible tax shield. But in fact

they do not borrow very much. Some typical debt

ratios are given in the table below. - In order to explain why firms do not borrow more,

we now turn to bankruptcy costs.

29

3. MM with bankruptcy costs 3.1 Bankruptcy

costs

- Costs of financial distress are

- Direct costs of bankruptcy.

- Indirect costs of bankruptcy.

- Agency costs of financial distress.

- (1) Direct Bankruptcy Costs

- Legal and administrative costs in bankruptcy and

liquidation. - Warner (1977, Journal of Finance, pp. 337-347)

reported that direct bankruptcy costs were on

average 5.3 of the overall market value of his

sample firms. - These magnitudes are small relative to the tax

advantage of debt.

30

3.1 Bankruptcy costs..

- (2) Indirect Costs of Bankruptcy

- Costs involved with the difficulties of running a

business while it is going through bankruptcy. - These costs are probably fairly substantial,

perhaps of the same order of magnitude as a

strike. - However, they are still small relative to the tax

shield on debt. - (3) Agency Costs of Financial Distress

- Costs associated with distortion of firms

incentives. - Suppose a firm has 1,000 in cash the day before

its 5,000 debt comes due. If the equity-holders

(or the managers acting on their behalf) do

nothing then the firm will go bankrupt and they

will get nothing. What should they do? The

manager might go to a Casino.

31

3.1 Bankruptcy costs..

- In another case, the firm might forego good

projects, where equity-holders have to share

rewards with bondholders. - Suppose the firm has no cash and has 10,000

debt. If it does nothing, the firm will go

bankrupt. Suppose the firm has the following

investment opportunity - Invest 2,000 Returns 11,000 with

certainty - This is clearly a very attractive project. Is it

worth the firm doing it? - If they do it, bondholders get 10,000.

Equity-holders will not put up the money for

investment since, even though it's a very good

project - Return to equity-holders' - 2,000 1,000 -

1,000.

32

3.2 MM with bankruptcy costs

- If firms have a high D/E ratio, they have a high

probability of bankruptcy. Incorporate

bankruptcy cost into MM - There is a trade-off between the tax advantage of

leverage and the disadvantage of leverage caused

by the costs of financial distress.

33

3.2 MM with bankruptcy costs..(Figure 4) D/E and

firm value

34

3.2 MM with bankruptcy costs..(Figure 5) D/E and

cost of capital

35

3.2 MM with bankruptcy costs..(Figure 6)

36

3.2 MM with bankruptcy costs..

- How can this theory be applied in practice?

- One can use standard NPV techniques to estimate

the value of an all-equity financed firm. - One can discount each year's interest tax shields

to estimate the PV of the interest tax shields.

- This leaves the costs of financial distress.

Direct measurement of the costs of financial

distress is not usually possible.

37

3.2 MM with bankruptcy costs..

- How can one find the optimal capital structure?

- Over time a firm's managers are able to get some

idea of their firm's costs of financial distress

and choose the debt ratio taking this into

account. - If one capital structure is better than another

in one industry, the firms using it will tend to

do better. - Over time firms will move toward an optimal

capital structure.