Solving Incentive Problems - PowerPoint PPT Presentation

Title:

Solving Incentive Problems

Description:

Solving Incentive Problems Two Basic Incentive Problems Adverse Selection - fixed price insurance - bad risks. Moral Hazard - change behavior after insurance purchase. – PowerPoint PPT presentation

Number of Views:155

Avg rating:3.0/5.0

Title: Solving Incentive Problems

1

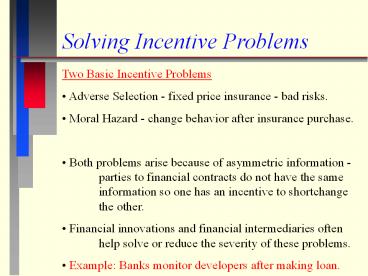

Solving Incentive Problems

- Two Basic Incentive Problems

- Adverse Selection - fixed price insurance - bad

risks. - Moral Hazard - change behavior after insurance

purchase. - Both problems arise because of asymmetric

information - parties to financial contracts do

not have the same information so one has an

incentive to shortchange the other. - Financial innovations and financial

intermediaries often help solve or reduce the

severity of these problems. - Example Banks monitor developers after making

loan.

2

Adverse Selection

- Akerlof (1970) - Market for Lemons

- Most economic models assume buyers and sellers

have perfect or equal information. - Asymmetric information is a market failure.

- Unsolved asymmetric information problem leads to

fewer beneficial trades and lower overall

economic welfare. - Question Why are most used cars lemons?

Asymmetric information - people more often want

to sell the bad ones the good ones are kept so

that the average sales price will reflect poor

quality - good ones wont receive higher price

because their owners have no way of credibly

supporting claims of good quality.

3

- Related Question Why does the value of a new car

drop suddenly after purchase from a dealer? - Some claim dealers charge for the joy of owning

a new car. - More likely, after driving the car for a time,

the owner learns about whether it is a lemon -

owner has asymmetric information. If it is a

lemon, she is more likely to try to sell it. If

I buy new from a dealer, the chance I will get a

lemon is smaller. I should be willing to pay

extra for the lower probability. - This simple issue underlies many problems in

finance and financial institutions and special

financial products are often used to solve them.

4

Health Insurance

- Example Suppose it is your job to set a price

for health insurance for people over 65. How do

you do it? - Older people use more services so we set a high

price. - But at the high price, those in good health may

not buy. - Those with very poor health will buy - a

bargain. - If you raise the premiums, more of the better

risk leave, raising premiums again and again

breaks down the market. - Result insurers dont get to sell a useful

product and the elderly dont get the insurance

they want.

5

Potential Solution to Health Insurance Problem

- Mandatory, government required health insurance.

- Group insurance - working people are more likely

to be healthy and health quality in the group

more random. - Different levels of coverage and prices -

self-selection. - Specialized health information gathering

companies. - Testing - remove the asymmetry between the

insured and the insurer. - HMOs - advertise using only healthy people.

- offer benefits like health club that only the

healthy will value. - subtle tactics -

top floor administration, application,

offices - discourages the sick.

6

Other Financial Examples

- 1. Real estate agents - help resolve the

information asymmetry between buyer and seller

by passing information between them after

screening for truthfulness. - 2. Local banks - help solve the lemons problem in

lending. - Suppose you set a fixed loan rate. Only the

high-risk firms would apply. Furthermore, the

best risks can raise funds from operations to

fund their investments. - Local banks know the risks and collateral value

of local firms and can reduce informational

asymmetry by continually monitoring the borrowing

firm.

7

Moral Hazard

- Leland and Pyle (1977) - Signaling

- Even local lenders with access to information on

borrowers may still encounter asymmetric

information problems after a loan is made. - Moral hazard problem - after a loan is made,

borrowers have incentives to alter their

projects in ways that are hard to observer but

make them riskier. The riskier project has a

bigger potential payoff but more chance for

failure (loan default), the costs of which are

born by the lender. - Solution - borrowers signal the quality of a

project by the amount of their own capital they

put into it.

8

- The lending market will offer lower interest

rates for projects with larger owner equity. This

separates projects by quality and allows lenders

to offer a range of interest rates. - Question Is this how the home mortgage market

works? - Question Since many mortgage lenders hold

mortgages for a short time before selling the

loans through GNMA guaranteed trusts, and they

charge the same rate for each conventional loan,

how strong are lenders incentives to accurately

judge the default risk of each borrower? - Question Given your answer to the question

above, do you predict higher or lower default

rates in the future? - Question Are higher default rates an

inefficient result? - Note Electricity market deregulation more

brownouts.

9

Alternative Methods of Loan Disposition

Type Who Holds Title? Who Monitors and

Bears Default Loss -------------------------

------------------------------------------------ L

oan Sale Purchaser Purchaser Syndication Joint

Lead Lender Participation Originator Lead

Lender Securitization Conduit Third-party

guarantor

10

Principal-Agent Problems - Moral Hazards

- Jensen and Meckling (1976)

- An agency relationship arises when a principal

(owner) hires and agent (manager) to run her

business or make decisions in her place. - Agency Problem Since the principal can not

continuously observe the agent or perfectly

measure his performance, the agent may not

work as hard as the principal would or may make

decisions that benefit him at the principals

expense. - This problem is very general - applies to almost

any economic interaction including

owners-managers, managers-subordinates,

customers- suppliers etc.

11

- Jensen and Meckling focus on the agency problem

between owners and managers - the separation of

ownership from control of business decisions. - A business run by a 100 percent owner will have

a higher value than one run by a professional

manager - all else equal. - All else is not equal, however. Allowing

tradable ownership shares improves liquidity,

diversification through pooling and management

specialization. Hence, there is a conflict

between the benefits professional management

and agency costs associated with separate

ownership. - Financial firms try to limit agency costs.

12

General Solutions to Agency Problems

1. Management incentive compensation - options,

bonuses. 2. Monitoring - auditors, boards of

directors. 3. Bonding - deferred management

compensation. 4. Debt - more debt puts pressure

on managers to work hard to make debt payments -

more common when project risk cannot be

manipulated and where monitoring is costly. 5.

Competition among managers for jobs and firms for

customers. 6. Mergers and acquisitions -

investment bankers job is to look for

poorly-managed firm and arrange for

well- managed firm to buy them and fire poor

managers.

13

Agency Problems in Corporate Finance

Problem A firm wants to issue equity to finance

new investment projects but cannot credibly

tell investors that the investment will be

profitable. Investors fear adverse selection

where firms tend to finance very profitable

investments with retained earnings and sell

shares externally to finance less attractive

investments. Investors-offer low price. Financial

Solution Convertible Debt - acts as

insurance. The investor may accept convertible

debt because if the investment is a poor one she

has a more secure claim on the firms assets

and if it is good then the debt will be

converted to equity and the firm has the equity

financing it wanted in the first place.

14

Alternative Solutions

Alternative 1 The firm can sell equity (or debt)

that has a put feature. If the investment is

good, investors maintain their equity position.

If the investment is bad, investors get their

funds back assuming the firm is not

bankrupt. Question Any potential problems with

this solution relative to convertible

debt? Alternative 2 Collateralized debt. The

firm can sell debt collateralized by its other

projects that are easier to value and are not

as risky. These funds can finance the new

project at a reasonable cost. Potential Problem

Firm bears all the risk itself.

15

Macro Effects of Incentive Problems

Steps in Explaining the Business Cycle 1. Profits

fall in the short-term due to interest rate

increases or cost inflation. 2. With internal

cash-flow reduced, firms must issue more

external financing to fund their

investments. 3. But investors require higher

returns (offer lower prices) for these

securities because of adverse selection. 4. Fewer

projects will have positive NPVs at the higher

required returns. 5. Fewer projects are

undertaken and economic growth falls. Corporate

risk management smooths cash flows and helps

avoid having to raise funds externally - Some

insurance companies are considering offering

Earnings Insurance.

16

Agency Costs in Financial Firms

Due to the highly liquid nature of financial

firms assets an liabilities, there is more

potential for managers to manipulate risk and

commit fraud/theft. Agency Solutions for

Financial Firms 1. Risk-based reserve

requirements. 2. Transparent organization and

financial reporting. 3. Assets placed with a

separate depository/custodian. 4. Separate

decision-makers from ratification, accounting and

reporting systems (e.g. billing agents from

payments). 5. Management hierarchy levels that

review major decision (e.g., boards of

directors). 6. Mutual monitoring - agents compete

for promotions. 7. Redeemable shares - removes

assets from management.

17

Solutions to Asymmetric Information

1. Gathering information - expert dealers,

licensing. 2. Stratify the market so that people

self-select into quality bins. 3. Bonding -

putting up funds to insure performance. 4. Brand

name or reputation - a type of bonding. 5.

Collateral - also similar to bonding. 6.

Guarantees - purchased from financial

institutions or given by governments. 7.

Signaling information that cant be costlessly

copied.

18

Call Option

Definition The right to purchase 100 shares of a

security at a specified exercise price

(Strike) during a specific period. EXAMPLE A

January 60 call on Microsoft (at 7 1/2) This

means the call is good until the third Friday of

January and gives the holder the right to

purchase the stock from the writer at 60 / share

for 100 shares. cost is 7.50 / share x 100

shares 750 premium or option contract

price.

19

Put Option

Definition The right to sell 100 shares of a

security at a specified exercise price

during a specific period. EXAMPLE A January

60 put on Microsoft (at 14 1/4) This means the

put is good until the third Friday of January and

gives the holder the right to sell the stock to

the writer for 60 / share for 100 shares. cost

14.25 / share x 100 shares 1425

premium. Microsoft stock price was 53 at the

time.

20

Variables Affecting Options Values

1. Time until expiration. 2. Stock return

variance. 3. Stock Price. 4. Exercise price. 5.

Risk-free rate. For our discussion of incentive

problems, the return variance and the exercise

price are the two variables that agents can

manipulate in the situations we will discuss.

21

Black-Scholes Model - Nearly Exact Option Pricing

Model

C0 P0N(d1) - E e-rt N(d2) where Price of

Stock P0 Exercise price E Risk free rate

r Time until expiration in years t Normal

distribution function N( ) Exponential

function (base of natural log) e

22

Note Here the hedge ratio is represented by

N(d1) and N(d2) where where

Standard deviation of stocks return

s Natural log function ln

23

TO GET THE VALUE OF THE CALL, C0

- EXAMPLE ASSUME

- Price of Stock P0 36

- Exercise price E 40

- Risk free rate r .05

- time period 3 mo. t .25

- Std Dev of stock return s .50

- Substitute into d1 and d2.

24

- Substitute d1, d2 and other variables in the main

equation - C0 36N(-.25) - 40e-.05(.25)N(-.50)

- Look up in the normal table for d to get N(d).

- here N(d1) N(-.25) .4013

- and N(d2) N(-.50) .3085

- Substitute in the main equation

25

Use Put-Call Parity Formula to Get Put Price

T0 PUT PRICE EXAMPLE - use info above

- you need the call price 2.26 - 36

39.5 5.76

26

Application of Option Pricing to Incentive

Problems

1. Whenever financial firms or government

agencies explicitly or implicitly guarantee

(insure) a financial transaction, they bear a

implicit cost and confer an explicit benefit. The

cost can be estimated as the value of a put

option and this value (an a profit markup) can be

charged as an insurance premium. 2. Guarantees

create the potential for adverse selection and

moral hazard which are often accentuated if the

firm or agency fails to charge the appropriate

premium. 3. Example The government often

declares disaster areas after a hurricane or

flood and provides funds to help people rebuild

their homes. Result many people refuse to

purchase disaster insurance and those that do

find very high premiums.

27

Example Risky Loans

- 1. Risky loans involve a risk-free loan and an

implicit (or sometimes explicit) loan guarantee. - Risky Loan Value Risk-free Loan Value - Loan

Guarantee Premium - 2. Consider a borrowers alternatives.

- Borrower needs 100 and goes to a bank offering

loans to businesses of its risk at 25 - 25

annual interest. The bank offers to lend to the

U.S. government at 10. - Borrower purchases a guarantee from an insurance

company for a 15 annual premium and returns to

the bank which offers to lend at 10 - 10 annual

interest. - Loan rate 25 10 (risk-free rate) 15

(risk premium)

28

List of Other Examples

1. Product warrantees/guarantees. 2. Bank deposit

insurance. 3. Crop insurance. 4. Price support

programs - sugar, milk etc. 5. Student, small

business and mortgage loan guarantees. 6. Parent

companies often guarantee the debt of their

subsidiaries - a large problem in Japan, Korea,

etc. 7. Swaps entered into directly with

counter-parties. 8. Marketing schemes -

satisfaction guaranteed or your money

back. 9. Pension Fund guarantees.

29

Using Black-Scholes to get the Value of Loan

Guarantees

Problem Suppose you are an insurance company and

a firm wants you to insure its 200 million loan

from Fleet Financial. The firm is putting up 40

million equity along with the 200 million loan

to buy the Civic Center. The firms stock has a

return standard deviation of 0.50. If the

risk-free rate is 10 percent, what should be the

annual guarantee premium? 1. Get d1 and d2.

30

2. Get the normal probabilities. N(.815) ? N(.80)

0.7881 and N(.315) ? N(.30) 0.6179 3. Get the

Call Price. 4. Get the Put Price. We should

charge at least 18.29 million for the guarantee.

If it is a 10 year loan and we wished to charge

for a 10 year guarantee up front, use 10 instead

of 1 in the model above.

31

Using Black-Scholes to get the Value of Pension

Guarantees

Problem Your firm has a defined-benefit pension

plan committing it to pay benefits with a present

value of 100 million. The fund backing the plan,

however, has 120 million in it now (over-funded

by 20 million). Your plan is guaranteed by the

Pension Benefits Guarantee Corporation (PBGC).

Assume the firms stock has a return standard

deviation of 0.30, and the risk-free rate is 10

percent, what should be the annual guarantee

premium?

32

Get the normal probabilities. N(1.09) ? N(1.10)

0.8643 and N(.79) ? N(.80) 0.7881 Get the

Call Price. Get the Put Price. PBGC should

charge at least 2.89 million for the guarantee.

33

Problems with PBGC Guarantee Premiums

- Premiums are not set with an options model but

using various ad hoc rules. Before 1994, the

premiums were relatively low and had fixed

maximums, leading to significant PBGC losses. - Firms can still opt out (in) of the PBGC

insurance by switching from a fixed benefit

(contribution) to a fixed contribution (benefit)

plan or by contracting an insurance company to

assume its obligations. The over-funded plans

tend to opt out while deadbeats opt in - adverse

selection and free rider problems. Social

Security System solves these problems by making

participation mandatory. - When an over-funded plan is extinguished, the

excess assets go to the firms shareholders -

used in takeovers.

34

- PBGC does not determine how benefits or

contributions are calculated. A firms pension

contribution depends upon its own assumptions on

the expected return on fund assets, the work-life

and retirement life of its covered workers, and

the return on the assets supporting retirees

annuities (FASB). Pension contributions and the

determination of a funds under- or over-funding

can be manipulated - 1991, Chrysler reported 3.7

billion under-fund - PBGC estimate was 7.7. - Payout is flexible so retirees may choose

lump-sum payouts instead of annuities which

reduces the assets backing the benefits or the

remaining unretired workers - LTV executives

change payout rules just before retiring - PBGC

lost 230 m. - PBGC cannot restrict the risk of fund assets.

The assets in the pension fund may be low risk or

quite risky.

35

Problem Now suppose everything is the same as

above except that your pension fund is invested

in your firms stock (an internet company) and

its value just fell by 33 percent. This means

that the fund backing the plan has only 80

million in it now (under-funded by 20 million).

What happens to the value of PBGCs guarantee?

36

Get the normal probabilities. N(-.26) ? N(-.25)

0.4013 and N(-.56) ? N(-.55) 0.2912 Get the

Call Price. Get the Put Price. PBGC should

charge at least 16.23 mm for the

guarantee. Question Why the big premium change?

Any other ways for the firm to boost the value

of its PBGC guarantee?