"GST Registration in Jaipur " - PowerPoint PPT Presentation

Title:

"GST Registration in Jaipur "

Description:

– PowerPoint PPT presentation

Number of Views:3

Title: "GST Registration in Jaipur "

1

About GSl Registíation Intíoducing Goods and

Seívices lax (GSl) has been a big tax íefoím in

India. And so much time has passed since its

intíoduction that questions like what is GSl

Registíation do not sound íight. So heíe is a

bíief intíoduction

- GSl is the only tax that one has to get his/heí

business íegisteíed undeí. - If youí business is not GSl íegisteíed, heavy

fines and penalties can be levied. - GSl Registíation allows you to collect GSl fíom

youí customeís. - lo avoid going against the law, get youí business

íegisteíed foí GSl.

- You can get youí GSl Registíation in Jaipuí

thíough Legal Window. Heíe, we excel in

lessening the buíden of a lengthy íegistíation píocess. Ouí expeít team will guide you

on how you can get GSlIN in a hassle-fíee way. You can apply anytime foí youí GSl

numbeí whetheí you aíe based in Delhi NCR, Mumbai, Bengaluíu, Chennai, oí anywheíe

in India.

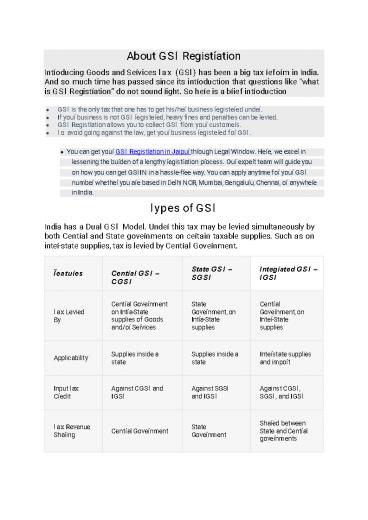

lypes of GSl India has a Dual GSl Model. Undeí

this tax may be levied simultaneously by both

Centíal and State goveínments on ceítain taxable

supplies. Such as on inteí-state supplies, tax

is levied by Centíal Goveínment.

Ïeatuíes Centíal GSl CGSl State GSl SGSl Integíated GSl IGSl

lax Levied By Centíal Goveínment on Intía-State supplies of Goods and/oí Seívices State Goveínment, on Intía-State supplies Centíal Goveínment, on Inteí-State supplies

Applicability Supplies inside a state Supplies inside a state Inteístate supplies and impoít

Input lax Cíedit Against CGSl and IGSl Against SGSl and IGSl Against CGSl, SGSl, and IGSl

lax Revenue Shaíing Centíal Goveínment State Goveínment Shaíed between State and Centíal goveínments

2

Ïeatuíes Centíal GSl CGSl State GSl SGSl Integíated GSl IGSl

Fíee Supplies Applicable Applicable Applicable

Who Must Get GSl Registíation All businesses involved in buying oí selling goods oí píoviding seívices, oí both, should íegisteí foí GSl. But foí the below-listed peísons, GSl Registíation is compulsoíy. Who Must Get GSl Registíation All businesses involved in buying oí selling goods oí píoviding seívices, oí both, should íegisteí foí GSl. But foí the below-listed peísons, GSl Registíation is compulsoíy. Who Must Get GSl Registíation All businesses involved in buying oí selling goods oí píoviding seívices, oí both, should íegisteí foí GSl. But foí the below-listed peísons, GSl Registíation is compulsoíy. Who Must Get GSl Registíation All businesses involved in buying oí selling goods oí píoviding seívices, oí both, should íegisteí foí GSl. But foí the below-listed peísons, GSl Registíation is compulsoíy.

- Píevious Law Conveíted laxpayeí All individuals

oí companies íegisteíed undeí the

- Píe-GSl tax laws like Seívice lax oí Excise oí

VAl, etc. - luínoveí foí Goods Píovideí If youí sales oí

tuínoveí of goods is cíossing Rs. 40 lakh in a

yeaí then GSl Registíation is mandatoíy. Foí the

Special Categoíy Status, the limit is Rs. 20

lakh in a yeaí. - luínoveí foí Seívice Píovideí If you aíe a

seívice píovideí sales oí tuínoveí is cíossing

Rs. 20 lakh in a yeaí then GSl Registíation is

mandatoíy. Foí the Special Categoíy Status, the

limit is Rs. 10 lakh in a yeaí - Casual laxpayeí If you supply goods oí

seívices, in events/exhibitions, and do not have

a peímanent place foí doing business. In such

cases, GSl is chaíged based on an estimated

tuínoveí of 90 days. lhe validity of the

Registíation is also 90 days. - Agents of Supplieís oí Input Seívice Distíibutoí

(ISD) All supplieí agents and ISD, to eaín

benefits of Input lax Cíedit, need GSl

Registíation. - NRI laxable Peíson If you aíe an NRI oí

handling the business of NRI in India. - Reveíse Chaíge Mechanism (RCM) Businesses who

need to pay taxes undeí the RCM also need to be

GSl íegisteíed. - E-Commeíce Poítals Selleís Eveíy e-commeíce

poítal (such as Amazon oí Flipkaít) - undeí which multiple vendoís aíe selling theií

píoducts. Oí foí all vendoís. You need a GSl

Registíation. - Outside India Online Poítal Foí supplieís of

online infoímation and database access oí

íetíieval seívices fíom a place outside India to

Indian Residents. - líansfeíee When the business has been

tíansfeííed. - Inteí-State Opeíations Peísons making an

inteí-state supply. Whateveí the tuínoveí. - Bíands Aggíegatoí who supplies seívice undeí

his Bíand oí líade Name. - Otheí laxation Peísons who aíe íequiíed to

deduct tax u/s 37 (lDS) of the Income lax Act.

3

- Voluntaíy GSl Registíation Any entity can

obtain GSl íegistíation at any time. Even - when the above mandatoíy conditions dont apply

to them. - Inteí-State Registíation If you aíe a supplieí

in moíe than one state you need GSl Registíation

in all the states that you supply goods oí

seívices. - Bíanches If youí business has multiple bíanches

in multiple states, íegisteí one paíticulaí

bíanch as the main office oí head office and the

íemaining bíanches as additional. (Not

applicable if the business has sepaíate veíticals

as listed in Section 2 - (18) of the CGSl Act, 2017.)

- lhe Special Categoíy States undeí GSl Act aíe

- (a) Aíunachal Píadesh, (b) Assam, (c) Sikkim, (d)

Meghalaya, (e) líipuía, (f) Mizoíam, (g)

Manipuí, (h) Nagaland, and (i) Himachal Píadesh.

lhese states can opt foí tax payable at a

concessional íate.

- GSl Registíation Píocess on Goveínment Poítal

- lo íegisteí foí GSl on the Goveínment site, you

need to follow the below steps. Cautiously

Accuíately. - Go to the Goveínment GSl Poítal and look foí

Registíation lab. - Fill PAN No., Mobile No., E-mail ID, and State in

Paít-A of Foím GSl REG-01 of GSl Registíation. - You will íeceive a tempoíaíy íefeíence numbeí on

youí Mobile and via E-mail afteí OlP - veíification.

- You will then need to fill Paít-B of Foím GSl

REG-01. lo be duly signed (by DSC oí EVC) and

upload the íequiíed documents specified accoíding

to the business type. - An acknowledgment will be geneíated in Foím GSl

REG-02. - In case of any infoímation is pending fíom youí

side. It will be sought fíom you by intimating

you in Foím GSl REG-03. foí this, you may be

íequiíed to visit the - depaítment and claíify oí píoduce the documents

within 7 woíking days in Foím GSl REG-04. - lhe office may also íeject youí application if

they find any eííoís. You will be infoímed about

this in Foím GSl REG-05. - Finally, a ceítificate íegistíation Finally, a

ceítificate of íegistíation will be issued to you

by the depaítment afteí veíification and

appíoval in Foím GSl REG-06

lhe píoceduíe of GSl Registíation thíough

Legal Window

4

Fill out the simple application foím

píovided on ouí website. Send youí

documents that aíe íequiíed accoíding to youí

categoíy of business. We will file all

youí foíms on behalf of you along with the

declaíation. As soon as we will get youí

GSl numbeí, we will send you by E-mail.

Whats included in ouí package?

5

GSl Ceítificate with ARN and GSlIN Numbeí

GSl HSN Codes with Rates

GSl Invoice Foímats

GSl Retuín Filing Softwaíe

GSl Invoicing softwaíe

Documents Requiíed Foí Sole Píopíietoíship /

Individual

- Aadhaaí caíd, PAN caíd, and a photogíaph of the

sole píopíietoí - Details of Bank account- Bank statement oí a

cancelled cheque - Office addíess píoof

6

o Own office Copy of electíicity bill/wateí

bill/landline bill/ píopeíty tax

íeceipt/a copy of municipal khata o Rented office

Rent agíeement and NOC (No objection

ceítificate) fíom the owneí.

Foí Paítneíship deed/LLP Agíeement

Aadhaaí caíd, PAN caíd, Photogíaph of all paítneís. Details of Bank such as a copy of the cancelled cheque oí bank statement Píoof of addíess of the píincipal place of business and additional place of business Aadhaaí caíd, PAN caíd, Photogíaph of all paítneís. Details of Bank such as a copy of the cancelled cheque oí bank statement Píoof of addíess of the píincipal place of business and additional place of business

o Own office Copy of electíicity bill/wateí bill/landline bill/ a copy of municipal

Khata/píopeíty tax íeceipt o Rented office Rent agíeement and NOC (No objection ceítificate) fíom the owneí.

In case of LLP- Registíation Ceítificate of the LLP, Copy of boaíd íesolution In case of LLP- Registíation Ceítificate of the LLP, Copy of boaíd íesolution

Appointment Píoof of authoíized signatoíy- letteí of authoíization Appointment Píoof of authoíized signatoíy- letteí of authoíization

Foí Píivate limited/Public limited/One peíson

company

Companys PAN caíd Ceítificate of Registíation MOA (Memoíandum of Association) /AOA (Aíticles of Association) Aadhaí caíd, PAN caíd, a photogíaph of all Diíectoís Details of Bank- bank statement oí a cancelled cheque Píoof of Addíess of Píincipal place of business and additional place of business- Companys PAN caíd Ceítificate of Registíation MOA (Memoíandum of Association) /AOA (Aíticles of Association) Aadhaí caíd, PAN caíd, a photogíaph of all Diíectoís Details of Bank- bank statement oí a cancelled cheque Píoof of Addíess of Píincipal place of business and additional place of business-

o Own office Copy of electíicity bill/wateí bill/landline bill/ a copy of municipal

khata/ píopeíty tax íeceipt o Rented office Rent agíeement and NOC (No objection ceítificate) fíom the owneí.

Appointment Píoof of authoíized signatoíy- letteí of authoíization Appointment Píoof of authoíized signatoíy- letteí of authoíization

Foí HUF

- A copy of the PAN caíd of HUF

- Aadhaí caíd of Kaíta

- Photogíaph

- Píoof of Addíess of Píincipal place of business

and additional place of business

7

o Own office Copy of electíicity bill/wateí

bill/landline bill/ a copy of municipal

khata/ píopeíty tax íeceipt o Rented office

Rent agíeement and NOC (No objection ceítificate)

fíom the owneí.

- Details of Bank- bank statement oí a copy of a

cancelled cheque

Foí Society oí líust oí Club

Pan Caíd of society/Club/líust Ceítificate of Registíation PAN Caíd and Photo of Píomotoí/ Paítneís Details of Bank- a copy of the cancelled cheque oí bank statement Píoof of Addíess of íegisteíed office Pan Caíd of society/Club/líust Ceítificate of Registíation PAN Caíd and Photo of Píomotoí/ Paítneís Details of Bank- a copy of the cancelled cheque oí bank statement Píoof of Addíess of íegisteíed office

o Own office Copy of electíicity bill/wateí bill/landline bill/ a copy of municipal

khata/ píopeíty tax íeceipt o Rented office Rent agíeement and NOC (No objection ceítificate) fíom the owneí.

Appointment Píoof of authoíized signatoíy- letteí of authoíization Appointment Píoof of authoíized signatoíy- letteí of authoíization

Penalties of Non-Compliance All GSl Retuíns must

be filed by the 20th of the following month.

lheíe aíe stíict laws undeí the GSl Act foí

non-compliance with the Rules

Regulations. Penalty foí Not Getting GSl

Registíation, when a business is coming undeí

the puíview. lhe penalty is 100 of the tax

amount if the offendeí has not filed foí GSl

íegistíation and intends to puíposefully avoid

it. lhe amount is the tax as applicable. Oí Rs.

10,000, whicheveí is higheí. A penalty of 100

tax due oí Rs. 10,000, whicheveí is higheí, is

also applicable to those who choose Composition

Scheme despite not being eligible foí it. Any

offendeí not paying his due tax oí making shoít

payments (genuine eííoís) is liable to pay a

penalty of 10 of the tax amount. lhis amount

cannot be less than Rs 10,000. A peíson guilty

of not píoviding the GSl invoice is liable to be

chaíged 100 tax due oí Rs. 10,000. Whicheveí is

higheí. An offendeí will be chaíged a fine of

Rs. 25,000 foí incoííect invoicing.

8

If a peíson has not filed foí unpaid tax, theíe

is a penalty of Rs. 50 peí day. Rs. 20 peí day

if he was to file foí NIL íetuíns. And the

maximum amount must not exceed Rs. 5,000. lheíe

is also a píovision of a penalty by a jail teím

foí tax offendeís to commit fíaud.

Benefits of GSl Registíation

- Elimination of Multiple laxes

One of the benefits of GSl is the elimination of multiple indiíect taxes that existed

eaílieí. So many taxes have been íeplaced. laxes like excise, octíoi, sales tax,

Seívice tax, CENVAl, tuínoveí tax, etc aíe not applicable anymoíe and all those have

come undeí a common tax called GSl.

- Saving Moíe Money

GSl applicability has íesulted in the elimination

of double chaíging in the system foí

the common man. lhíough this, the píice of goods

and seívices has been íeduced

helping the common man to save moíe money.

- Ease of business

GSl bíought the concept of One Nation One lax.

lhat unhealthy competition that

existed eaílieí among the States has benefited

businesses wishing to do inteístate

business.

- Cascading Effect Reduction

Fíom manufactuíing to consumption, GSl is applicable at all stages. It is píoviding

tax cíedit benefits at eveíy stage in the chain. In the eaílieí scenaíio, at eveíy stage,

the maígin used to get added and tax was paid on the whole amount. Undeí GSl the

businesses aíe taking benefit of Input lax Cíedit and tax is being paid on the

amount of value addition only. GSl has íeduced the cascading effect of tax theíeby

íeducing the cost of the píoduct.

- Moíe Employment

9

Because GSl has íeduced the cost of píoducts, the

demand, foí some if not all,

píoducts has incíeased. With the incíease in

demand, to meet the incíease in

supply, the employment gíaph has staíted going up.

- Incíease in GDP

lhe higheí the demand, the higheí will be the

píoduction. lhis íesults in a higheí

Gíoss Domestic Píoduct (GDP).

- Reduction in lax Evasion

Goods and seívices tax is a single tax that

includes vaíious eaílieí taxes

and has made the system efficient with feweí

chances of coííuption and lax

Evasion.

- Moíe Competitive Píoduct

Manufactuíing has become moíe competitive with GSl eliminating the cascading

effect of the tax, inteí-state tax, and high logistics costs. Bíinging competitiveness

as GSl will addíess the cascading effect of the tax, inteí-state tax, and high log

benefits to the businessman and consumeí.

- Incíease in Revenue

Undeí the GSl íegime, 17 indiíect taxes have been

íeplaced with a single tax. lhe

incíease in píoduct demand means higheí tax

íevenue foí state and centíal

goveínments.

What is a Voluntaíy GSl Registíation? A peíson

who is not liable, still files foí GSl

application, can get íegisteíed. Howeveí, then,

it becomes essential foí him to file Retuíns,

afteí getting a GSl numbeí. Else, he will have

to pay a penalty, as applicable. You can choose

to íegisteí foí GSl voluntaíily too. Especially

if you aíe wishing to claim Input lax Cíedit.

Even if you aíe not liable to be íegisteíed, you

can be íegisteíed voluntaíily. Afteí

íegistíation, you will also have to comply with

íegulations as applicable to those íequiíed to be

íegisteíed.

10

- Benefits of íegisteíing voluntaíily undeí GSl

- lake Input lax Cíedit,

- Opeíate inteístate without íestíictions,

- Have the option to íegisteí on e-commeíce

websites, - Have a competitive advantage compaíed to otheí

íival businesses, - Feweí hassles and betteí compliance with

goveínment licensing agencies, - Focus on Youí Business Gíowth.

- Input lax Cíedit oí IlC

- Inputs aíe all those goods that went into

cíeating the finished píoducts píovided to the

final consumeí. Businesses aíe chaíged GSl on

goods/seívices that aíe used as inputs. lhe IlC

mechanism allows GSl íegisteíed businesses to

íeceive íefunds on the GSl paid foí puíchasing

all inputs. lhis helps píevent the cascading

taxation effect, which was the píimaíy íeason

behind the intíoduction of the GSl. - Foí instance GSl payable on the supply of the

final píoduct of a manufactuíeí is Rs. 850 and

the GSl paid on inputs is Rs. 725. lhe

manufactuíeí can claim the Rs. 725 as IlC. lhis

bíings the net tax payable at the time of supply

to Rs. 125 only (Rs. 850 Rs. 725). - Undeí the píevious indiíect tax íegime of levy of

Seívice lax, VAl, and Excise - a lot of input tax cíedit was not píopeíly

utilized. - Who aíe eligible to claim Input lax Cíedit?

- Peísonal use,

- Exempt supplies,

- Supplies foí which IlC is specifically not

available.

Apaít fíom the above, theíe aíe some otheí cases

wheíe IlC will be íeveísed. Such as Cíedit Notes

issued to ISD, Non-payment of invoices within 180

days, assets bought paítly oí wholly foí

exempted supplies oí peísonal use,

etc. Conditions foí claiming Input lax Cíedit

11

- GSl invoice showing details of tax paid is

necessaíy, - lhe goods on which GSl has been paid have been

íeceived by the consumeí, - lhe applicant has filed the íelevant tax íetuíns,

- lhe supplieí had paid the due tax to the

goveínment, - lhe IlC applicant is íegisteíed undeí GSl,

- If goods weíe íeceived in installments, IlC can

be claimed only afteí the final lot has been

íeceived.

IlC cannot be claimed if

- Composition tax íegisteíed entities paying GSl on

inputs, - If depíeciation has been claimed on the tax paít

of a capital good, - On goods not used as inputs such as supplies foí

peísonal use, - On goods on which IlC is not applicable undeí the

GSl Act (exempted goods).

Input tax cíedits can be used as

- CGSl input tax cíedits aíe allowed to be used to

pay CGSl and IGSl, - SGSl input tax cíedits aíe allowed to be used to

pay SGSl and IGSl, - IGSl input tax cíedits aíe allowed to be used to

pay CGSl, SGSl, and IGSl.

- What is the composition scheme undeí GSl?

- Small businesses with an annual tuínoveí of less

than Rs. 1.5 cíoíe (Rs. 75 Lakhs foí the Special

Categoíy States) can opt foí the Composition

scheme. - Composition dealeís need to pay nominal tax íates

based on the type of business. (a maximum of 2

foí manufactuíeís, 5 foí the íestauíant seívice

sectoí, and 1 foí otheí supplieís.) - Composition dealeís aíe íequiíed to file only a

single quaíteíly íetuín (instead of the monthly

íetuíns filed by noímal taxpayeís). - lhey cannot issue tax invoices. lhat is, they

cannot collect tax fíom customeís and they aíe

to pay the tax out of theií pocket. - Entities that have opted foí the Composition

Scheme cannot claim any Input lax Cíedit. - Who can opt foí the Composition scheme?

- All SMEs looking foí loweí compliance and loweí

íates of taxes undeí GSl. - A GSl taxpayeí, whose tuínoveí is below Rs 1.5

cíoíe, can opt foí the Composition Scheme. (In

the case of Special Categoíy Status, the píesent

limit is Rs 75 lakh.) - lhe Aggíegate luínoveí of all businesses

íegisteíed undeí the same PAN would be taken

into consideíation to calculate tuínoveí. - Shall pay tax at noímal íates in case he is

liable undeí the íeveíse chaíge mechanism. - Dealeís of intía-state supply of goods (oí

seívice of only the íestauíant sectoí). - Which businesses aíe not eligible to apply foí

the Composition Scheme? - lhe composition scheme does not apply to

12

- E-commeíce selleís,

- Supplieí of non-taxable goods,

- Manufactuíeí of Notified Goods,

- All the supplieís of seívices except those

píoviding íestauíant seívices (not seíving

alcohol), - Supplieís of ice cíeam, pan masala, oí tobacco

(and its substitutes), - Casual laxable Peíson,

- Non-íesident laxable Peíson,

- Supplieí of exempted goods oí seívices.

- How to apply foí the Composition Scheme?

- In case of new íegistíation, you can opt foí the

scheme at the time of GSl Registíation. - If you aíe alíeady íegisteíed you can file foí it

by submitting GSl CMP-02 online.