INTEREST - PowerPoint PPT Presentation

Title:

INTEREST

Description:

i is the effective rate of interest per year. ... In the case of the Spragga Dap credit, the annual effective rate of interest is ... – PowerPoint PPT presentation

Number of Views:80

Avg rating:3.0/5.0

Title: INTEREST

1

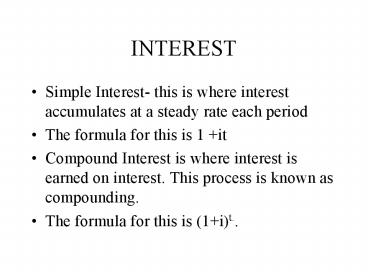

INTEREST

- Simple Interest- this is where interest

accumulates at a steady rate each period - The formula for this is 1 it

- Compound Interest is where interest is earned on

interest. This process is known as compounding. - The formula for this is (1i)t..

2

- Different components

- Principal is the original amount that was

invested. - i is the effective rate of interest per year.

- t is the time period in which the principal was

invested. - Accumulated Value is what your principal

3

- has grown to, denoted A(t).

- Therefore .

- Interest Accumulated Value-Principal

- Compound Interest is the most important to

remember due to the fact that it is used mostly

in situations. It has exponential growth whereas

simple interest has linear growth.

4

- Example Someone borrows 1000 from the bank on

January 1, 1996 at a 15 simple interest. How

much does he owe on January 17, 1996? - Solution Exact simple interest would give you

10001(.15)(16/365)1006.58. - However..

5

- Bankers rule uses 360 days, which gives a

different result. - Solution 10001(.15)(16/360)1006.67, which

is slightly higher. - Canada uses exact simple interest.

6

- Example - Jessie borrows 1000 at 15 compound

interest. How much does he owe after two years? - Solution 1000(1.15)21322.50.

7

- Assuming a 3 rate of inflation 1 now will be

worth 1.033 or 1.09 in three years. - Example How much was 1000 worth 4 years ago

assuming a 3 inflation rate? - Solution It is worth 1000(1.03)-4, which is

equal to 888.49.

8

- Nominal rate of interest is a rate that is

convertible other than once per year. - i(m) is used to denote a nominal rate of interest

convertible m times per year, which implies an

effective rate of interest i(m) per mth a year,

so the effective rate of interest is - i1 (i(m)/m)m-1.

9

- Example Find the accumulated value of 1000

after three years at a rate of interest of 24

per year convertible monthly. - Solution- i1(.24/12)36-1.26824.

- So the answer to the problem is

1000(1.26824)32039.88.

10

- Also, this is just something to remember.

- Suppose XXY credit card is offering 12

convertible monthly and Spragga Dap credit card

is offering 12 convertible semi-annually, which

has the best deal. - Solution- XXY has an effective annual interest

rate of 1(.12/12)12-1.12683.

11

- In the case of the Spragga Dap credit, the annual

effective rate of interest is - i1(.12/2)2-1.1236, which is lower than the

XXY credit card. - So, the rule to remember is, given the same

nominal rate, the effective annual rate of

interest will be higher if it is compounded more.

12

- Suppose we wanted to find a nominal rate of

interest compounded continuously, which is the

force of interest. - There is a formula for this ln(1i).

- Example Suppose i was fixed at .12 and we wanted

to find i(m), we would use the formula i.121

(i(m)/m)m-1 and solve for i(m). We will see

that

13

- i(2).1166

- i(5).1146

- i(10).1140

- i(50).1135

- and if the nominal rate of interest is

compounded continuously, then it would be - ln(1.12).11333.

14

ANNUITIES

- An annuity is a stream of payments.

- The present value of a stream of payments of 1

is an. - The formula for an is (1-vn)/iwhere v(1/1i)

- Suppose we were to take out a 50000 from the

Spragga Dap bank. If the mortgage rate is 13

convertible semi-annually, what would the monthly

payment be to pay off this mortgage in 20 years?

15

- Solution

- First, we find i, which is (1.065)(1/6)-1, then

we proceed to set up the problem. - 50000X.a240

- An1-(1/1.01055)240/.0105587.1506 so

- X50000/87.1506573.72

16

- Heres a tricky one!

- Suppose Haskell Inc. supplies you with a loan of

5000 that is supposed to be paid back in 60

monthly installments. If i.18 and the first

payment is not due until the end of the 9th

month, how much should each one of the 60

payments be?

17

- Solution first we convert i into a monthly

rate, which is 1.18(1/12)-1. - Then we have to account for the fact that the

5000 earned interest in the 1st 8 months. The

new amount is 5000(1.013888)8 which is 5583.29

so. - 5583.29X.a60

18

- a601-(1/1.013888)60/.01388840.5299

- Finally, 5583.3/40.5299137.76

- So we would need 60 payments of 137.76 to pay it

off in 60 monthly installments. - Note If we were supposed to take out a loan

which was repaid starting immediately, we would

use a double-dot which is an(1i).

19

BONDS

- Investing in bonds is a good way to utilize your

dollar. It is as simple as this. For a sum of

money today, you will get interest annuity

payments as well as another sum of money, known

as redemption value, when the time period has

elapsed.

20

- There are a few key components to get familiar

with when analyzing bonds. - F is the face value or par value of the bond.

- r is the coupon rate per interest period.

Normally, bonds are paid semi-annually. - C is the redemption value of the bond. The phrase

redeemable at par describes when FC.

21

- i is the yield rate per interest period

- n is the number of interest periods until the

redemption date. - P is the purchase price of the bond to obtain the

yield rate i.

22

- The price of the bond can be obtained by solving

this formula - PFr.anC(1i)-n

- Example A bond of 500, redeemable at par in

five years, pays interest at 13 per year

convertible semi-annually. Find a price to yield

an investor 8 effective per half a year.

23

- Solution FC500, r.065, i.08, n10.

- So the price of this bond is

- 32.5a10500(1.08)-10449.67.

- Example Spragga Dap Corporation decides to

issue 15-year bonds, redeemable at par, with face

amount of 1000

each. If interest payments are to

be made at a rate of 10 convertible

semi-annually,

24

- And if the investor is happy with a yield of 8

convertible semi-annually, what should he pay for

one of these bonds? - FC1000, n30, r.05 and i.04

- so the price is 50.a301000(1.04)-301172.92