Individual Tax Formula - PowerPoint PPT Presentation

1 / 29

Title:

Individual Tax Formula

Description:

Filing status affects tax rate brackets, standard deduction, and many other amounts ... Filing solely for refund of all taxes withheld ... – PowerPoint PPT presentation

Number of Views:664

Avg rating:3.0/5.0

Title: Individual Tax Formula

1

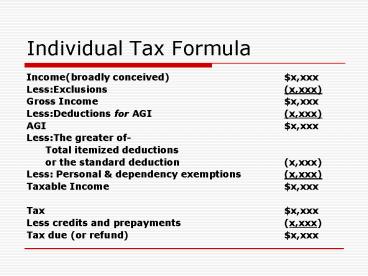

Individual Tax Formula

- Income(broadly conceived) x,xxx

- LessExclusions (x,xxx)

- Gross Income x,xxx

- LessDeductions for AGI (x,xxx)

- AGI x,xxx

- LessThe greater of-

- Total itemized deductions

- or the standard deduction (x,xxx)

- Less Personal dependency exemptions (x,xxx)

- Taxable Income x,xxx

- Tax x,xxx

- Less credits and prepayments (x,xxx)

- Tax due (or refund) x,xxx

2

Components of the Tax Formula

- Income

- Includes all income, both taxable and nontaxable

- Exclusions

- A partial list of income exclusions is provided

in Exhibit 16-1 - Gross income

- A partial list of gross income items is provided

in Exhibit 16-2

3

Components of the Tax Formula

- Deductions for Adjusted Gross Income include

(Partial List) - Expenses incurred in a trade or business

- 1/2 of self-employment tax paid

- Alimony paid

- Payments to IRAs and Health Savings Accounts

- Moving expenses

- Capital loss deduction (limited to 3,000)

4

Itemized Deductions vs.Standard Deduction

- Deduct the greater of itemized deductions or the

standard deduction - Itemized deductions - certain personal expenses

such as medical expenses and charitable

contributions - Standard deduction - a specified amount based on

filing status, age, and blindness

5

Personal and Dependency Exemptions

- Generally, one for each person

- Amount is indexed for inflation each year

6

Filing Status

- There are 5 filing statuses

- Married, filing jointly

- Surviving spouse (qualifying widow or widower)

- Married, filing separately

- Single

- Head of household

- Filing status affects tax rate brackets, standard

deduction, and many other amounts

7

Filing Status - Head of Household

- Must be unmarried at end of year

- Must pay gt half the cost of maintaining a

household - Home must be the principal home of a dependent

relative for more than half of tax year - Exception for temporary absence such as school

- Abandoned spouse

- Same as above plus spouse did not live in home

last 6 months

8

Standard Deduction (Table 16-1)

- The basic standard deduction (BSD) amount depends

on filing status of taxpayer - Filing status 2008 2009

- Single 5,450 5,700

- MFJ, SS 10,900 11,400

- HH 8,000 8,350

- MFS 5,450 5,700

9

Standard Deduction (Table 16-2)

- The additional standard deduction (ASD) for

taxpayers age 65 or older and/or legally blind - Filing status 2008 2009

- Single 1,350 1,400

- MFJ, SS 1,050 1,100

- HH 1,350 1,400

- MFS 1,050 1,100

10

Standard Deduction

- Examples (2009 tax year)

- Taxpayer is single, blind, and age 65 or older

- SD 5,700 (BSD) 1,400 (ASD) 1,400 (ASD)

8,500 - Taxpayers are married, filing jointly, one blind,

and both age 65 or older - SD 11,400 (BSD) 1,100 (ASD) 1,100 (ASD)

1,100 (ASD) 14,700

11

Real Property and Auto Sales Tax Standard

Deductions

- New for 2009 to stimulate economy

- Real property tax Lesser of actual or 500

(1,000 for joint return) - Auto sales tax

- Purchase between 2/17/09 and 12/31/09

- Must be a new vehicle weighing 8,500 lbs or less

- Tax on only first 49,500 of purchase price

- Phased out where AGI greater than 125,000

(250,000 for joint return)

12

Standard Deduction

- Taxpayers who are ineligible to use the SD

- Married, filing separately when other spouse

itemizes deductions - Nonresident aliens

- Individual filing return for tax year of less

than 12 months due to change in accounting period

13

Special Limitations on Basic Standard Deduction

- Individual claimed as dependent has a BSD limited

to the greater of - 950 or

- 300 plus earned income (but not exceeding normal

BSD) - ASD amount(s) still available

14

Standard Deduction Examples for 2009

- A blind child who earns 200 and is claimed by

parents as a dependent - SD 950 (BSD) 1,400 (ASD) 2,350

- A child who earns 1,500 and is claimed by

parents as a dependent - SD 1,800 BSD equal to greater of 950 or

(300 1,500 earned income) - A child who earns 6,500 and is claimed by

parents as a dependent - SD 5,700 BSD limited to normal amount

15

Personal and Dependency Exemptions

- Amounts Adjusted annually for inflation

- 2008 3,500 per exemption

- 2009 3,650 per exemption

- Personal exemption

- One per taxpayer

- Two personal exemptions when married filing

jointly) - Dependency Exemption tests

- Qualifying child or Qualifying relative

- Joint return

- Citizenship or residency

16

Dependents Qualifying Child Tests

- Relationship

- Abode

- Age

- Support

17

Dependents Qualifying Relative

- Qualifying relative or member of household

- Gross income less than exemption amount (3,650

for 2009) - Support

18

Dependency Exemptions - Relationship

- Dependent must be a qualified relative or a

member of the taxpayers household for the entire

year - Once a relationship is established by marriage,

it continues even if there is a change in marital

status

19

Dependency Exemptions Support Test

- gt50 of the dependents support

- Two exceptions to the support test

- Multiple support agreements

- Children of divorced parents

20

Dependency Exemptions Gross Income

- Dependents gross income must be less than amount

allowed for an exemption (i.e., 3,650 for 2009) - Example - Grandparent (age 70) meets all

dependency tests for taxpayer except has gross

income of 3,800 - Grandparent fails gross income test and cannot be

claimed by taxpayer as dependency exemption

21

Qualifying Child Qualifying Relative

Requirements - Joint Return

- Dependent cannot file a joint return with spouse

unless - Filing solely for refund of all taxes withheld

- No tax liability exists for either spouse on

separate returns - Neither spouse required to file return

22

Qualifying Child Qualifying Relative

Requirements Citizen or Residency

- Dependent must be a U.S. citizen, or

- a resident of U.S., Canada, or Mexico

23

Personal and Dependency Exemptions

- Phase-out of exemption benefits applies when

taxpayers AGI in 2009 exceeds - 250,200 for married, filing jointly, or

surviving spouse - 208,500 for head of household

- 166,800 for single

- 125,100 for married, filing separately

- Exemption deduction is reduced by 2 for every

2,500 (1,250 for MFS) or part thereof, that AGI

exceeds threshold amounts

24

Individual Income Taxes Rates

- Tax rates for 2009 are 10, 15, 25, 28, 33,

and 35 - Rates were higher prior to 2003 Tax Act

- Proposed 5.3 increase for taxpayers over

500,000 (1,000,000 MFJ) taxable income for

2010. - Tax rate brackets are inflation adjusted yearly

- Maximum rate for long-term capital gains and

dividends is 15 (0 in 2009 for persons in the

10 or 15 bracket for ordinary income)

25

Computing Income Tax

- Example 1 MFJ with taxable income of 96,000 in

2008 - TI lt 100,000, so use Table (Page A-14) 16,694

- Example 2 MFJ with taxable income of 120,000

in 2009 - TI gt 100,000, so use Schedule (Inside front

cover) - Step 1 (Tax on 67,900) 9,350

- Step 2 (Tax on next 52,100 at 25) 13,025

- Total 22,375

- 120,000 67,900 52,100

26

Kiddie Tax

- Net unearned income (e.g., interest, dividends,

capital gains) of child is taxed at parents rate - Child must be under age 19 at end of year or

under age 24 and a full time student - NUI generally equals unearned income less 1,900

(2009 tax year)

27

Kiddie Tax

- Computing NUI for Kiddie Tax

- Unearned income

- Less 950

- Less the greater of

- i) 950 of the standard deduction, or

- ii) allowable itemized deductions for unearned

income - Equals net unearned income

28

Filing Requirements

- Tax return

- Must file if gross income equals or exceeds the

standard deduction and personal exemption amount - ASD for blindness does not apply for this

determination - Special rules for dependents and self-employed

taxpayers

29

Filing Requirements

- Tax return

- Individual returns are due on or before the 15th

day of the 4th month after taxpayers year end - Most individuals are calendar year taxpayers,

thus, due date is April 15 - May obtain an extension of time to file until

October 15 - IRS is pushing e-filing