Working Group Status - PowerPoint PPT Presentation

1 / 15

Title:

Working Group Status

Description:

CPs still await DDQ & Real-time, Elevated Best Efforts and Assured Rate elements ... Industry eagerly awaits Indicative Pricing for both VLA and WBCC ... – PowerPoint PPT presentation

Number of Views:320

Avg rating:3.0/5.0

Title: Working Group Status

1

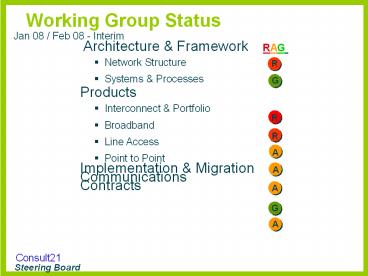

Working Group Status

Jan 08 / Feb 08 - Interim

RAG

- Architecture Framework

- Network Structure

- Systems Processes

- Products

- Interconnect Portfolio

- Broadband

- Line Access

- Point to Point

- Implementation Migration

- Communications

- Contracts

R

G

R

R

A

A

A

G

A

2

Network Structure

- RAG Status RED

- Key Issues (For Discussion)

- VLC planning rules and architecture

- NDA agreements on who CPs contact in BT

regarding network inventory dataset

Key Milestones Jan/Feb Achievements A further

release of the Network Inventory issued. Good

progress being made on providing security and a

workable process for CPs to obtain datasets .A

cross group focus team have been formed to

resolve this issue Define the VLC interface spec

ie SIP/MX SIP/MW ND1619

Feb/Mar / Work plan

Network inventory - Provide new release of the

network inventory and easier access to

dataset Review the requirements of NSWG Define

the VLC interface spec ie SIP/MX SIP/MW

ND1619 Review capabilities of the Innovation

Platform Derive requirements for VLA phase2 for

NICC actitatives

Time (R)

Cost (G)

Quality (G)

Customer Sat. (R)

Information (R)

Status

3

Systems Processes

- Key Milestones

- Jan/Feb Achievements

- SP WGs were held on the 16th January and 12th

February to review the new BTW systems roadmap.

The key focus of these meetings was to review the

format and content to ensure they meet CP

requirements. The aim is to provide the

information on a roadmap via BTW.com that allows

us to align systems investment and development

across the industry. - NICC B2B held a review on the 30th to agree the

work programme for 2008. As a result of this it

will include the following - Complete work on L2C standard and T2R generic

schema. - Produce proposals for further prioritisation for

the following - Location/Address matching Global Crossing

- Appointing/Arranging access

Consultant - Billing (L2C) CW

- Service Inventory Catalogue Thus

- T2R Structured Information BT

- Gateway instrumentation, monitoring management

tba - SLA management / MIS tba

- E2E PCK (Primary Correlation Key) tba

- T2R problem escalation management

tba - Tools for structuring information about B2B

interfaces BT - B2B Development (C2M) guide BT

- Systems/platform Migration best practice guide BT

- Continue work on international standards

alignment with TNF, OBF, ITU, etc

- RAG Status Green

- Key Issues (For Discussion)

- Issues discharged from here to the relevant WG,

ie IM WG in most cases.

Time (G)

Cost (G)

Quality (G)

Customer Sat. (G)

Information (G)

Status

4

Interconnect Portfolio

- RAG Status Red

- Key Issues (For Discussion)

- Lack of SVLAN and conversion indicative pricing,

with no date for a date. - Concern at uncertainty of when NGN CC will be

available / have 21CN traffic awaiting output

of Voice Strategy work as part of DSP.

- Key Milestones

- Jan/Feb Achievements

- NGN CC Interoperability discussions continued

with CPs - Contracts for NGN CC initial meeting held

- Detailed discussion held with CPs on NGN FOA0

testing phase - Feb/Mar Work plan

- Continue with NGN CC Interoperability

- Progress NGN CC trial preparations

- Continue discussions on NGN CC contracts

Time (R)

Cost (G)

Quality (G)

Customer Sat. (R)

Information (R)

Status

5

Broadband

Key Milestones

- RAG Status Red

- Key Issues

- CPs still await DDQ Real-time, Elevated Best

Efforts and Assured Rate elements of WBC pricing

and Indicative Launch pricing for WBMC to allow

CPs them to prepare business cases/make supplier

and product decisions for 2008 onwards - WBC DDQ pricing is key to a successful

consultation on IPstream Datastream sunsetting

- Jan/Feb Achievements

- BBWG held on 13rd February covering

- WBCC/WBC/WBMC/IPstream Connect update

- Speed Profile for ADSL2

- ADSL2 and CPE compatibility/Availability Checker

- Consultation closure WBC FTTP DDQ

- WBC Service Availability Schedule now released

through 21CN Migrations Portal - WBC draft contracts available for review CP

feedback - WBC Migrations workshop held 12th Feb

- Feb / Mar Work plan

- Walk-through of WBC Migrations process 26th

February - Release of WBC Migrations Handbook

- next Working Group is to be held on 18rd March

- BB Availability Checker demo

- WBC - SLAs performance for DDQ, RT etc

- Customer Trials update

- Review of WBC pricing feedback

- Discussion on communications managing end users

(CPE Compatibility, speed, marketing best

practice, home-wiring etc) - Bi-laterals on IPstream Datastream sunsetting

Time (R)

Cost (G)

Quality (G)

Customer Satisfaction (A)

Information (R)

6

Line Access

Key Milestones Jan/Feb Achievements Industry

issued a Condoc via the Consult21 process

(LA-009) on 21CN Access Products with responses

due in January 2008 Topics covered were 21CN

Deployment Strategy Plan Update VLA and WBCC

product development and project plans Condoc on

Industry requirements for 21CN February/March

Work plan The next meetings are to be held on

21st February 2008. Industry to progress ISDN

requirements within 21CN. VLA feasibility project

plan

- RAG Status Amber

- Key Issues

- Industry eagerly awaits Indicative Pricing for

both VLA and WBCC - Further work is required in NICC to support VLA

phase 2. Industry are concerned that the

publication of NICC standards may be on the

critical path due to BT resource - The 21CN Deployment Strategy Plan Update has

raised a number of issues on the future of Voice

and ISDN.. - Responses required to the Industry Condoc, then

an SOR to BT Group covering a number of key

issues on the future of voice and broadband

products

Time (A)

Cost (A)

Quality (A)

Customer Sat. (A)

Information (A)

Status

7

Point to Point

- RAG Status Amber

- Key Issues

- Industry still require a fuller consultation on

Openreach ORCHID product. - Openreach have issued indicative prices and plan

to increase product collateral shortly. - Openreach are progressing with their

re-examination of their product launch processes

including how to engage with industry. This will

be managed via a third party and is reported on

at the Steering Board. - Exchange Openings and Closures. Industry require

a much more extensive report on BTs processes

for timely communications with CPs of exchange

openings, closures and changes in network roles.

Note agreed with BT Group Property to have a

joint session to revisit existing closure process

- Industry await Openreach input on the future of

TDM products to align with the TDM Condoc

Key Milestones Jan/Feb Achievements MSIL (1G) now

live TDM consultation closed Fuller update to be

provided after the next WG Feb/Mar Work Plan The

next P2P WG meetings will be held on 22nd Feb 08

and 19th March 08 TDM Condoc - final responses

document to be issued by end Jan 08 Continue

Openreach TDM bilaterals with CPs, coordinate

with BT Group on approach and outcome. Look at

exchange management scenarios to tune

opening/closing process

Time (G)

Cost (G)

Quality (G)

Customer Satisfaction (G)

Information (A)

Status

8

Implementation Migration (CT)

- Key Milestones

- Dec/Jan Achievements

- Launched Deployment Strategy Plan multilateral

engagement. - Pre-migration scheduling consultation concluded

(C21-IM-030 refers) all feedback reviewed and

requirements formally with project team - Launched re-scoped weekly Pathfinder Review

calls, including operational readiness updates. - Jan/Feb Work plan

- Continue Deployment Strategy Plan consultations.

- Issue the Bedlinog In Life learning closure

report and review with industry. - Develop an outcome based plan further in-life

learning/end user feedback processes to support

Pathfinder activity - Final review of WG comms action plan with CPs.

- Complete development of migration customer

experience scenarios (network features and

incident comms) - Conclude ISDN Testing consultation inc scheduled

workshops - Integrate WBC implementation work into IMWG work

stack

- RAG Status Amber

- Key Issues (for discussion)

- Availability of Pathfinder schedule/plan,

national migration schedule and clarity on the BT

21CN implementation strategy information _at_ red

reflects this concern - Lack of clarity on dates/timeframes for

migration/implementation activity is affecting

CPs ability to plan for implementation/migration

and keep motivation and focus within their

organisations. - Deployment Strategy Plan seen as fundamental

shift in policy on new/existing products, which

impacts on CP investment plans.

Time (A)

Cost (G)

Quality (G)

Customer Satisfaction (G)

Information (R)

Status

9

PSTN Migration (Wick Bedlinog re-migrations)

Wick Bedlinog re-migration tbc

Update 12/02/08

RAG Status Amber

10

PSTN Migration Phase 2

Update 12/02/08

RAG Status Red (see commentary)

11

Interconnect Route Migration Review

- Capacity distributed mid November

- SPOC in CTC for CMR issues

- T3a programme almost complete bar some

renegotiated dates - BT has announced that the principles on which it

was planning/prioritising its 21CN implementation

activity in 2008/early 2009 will no longer be

network engineering driven but rather centred

round the implementation of new services and that

the proposed CP migrations from the DLE layer to

the NGS's will instead now be determined by the

Communication Providers themselves. Further

discussion to assess the impact of this strategy

is due at the next Prov Experts meeting on 18th

January.

Key actions/Next Steps

Element Description

- No O/S issues

Admin Phase

- VCONN reports being improved

Preparation Phase

- All T1 circuits now complete.

- T2 circuits now complete

- T3 commenced

Transfer Phase

- CMRs to be analysed, reviewed and fixes applied.

Post Transfer Phase

- Assessing billing for BAU VIC

VIC Product

12

Migration Communications

February 08 achievements / March 08

plans Webcalls An overview of WBCC product

development and agile working webcall was held on

5th February with 59 people joining via audio, 50

via web invite sent Corporate communications

work progressing on developing the corporate

communications for the nine chosen vertical

sectors and associated trade associations.

Broadband communications meeting held with the

working group on the NGN broadband programme.

The call was well received and CPs are now

considering the communications support they need

for their communications, either internally or

externally to their end-users. Other Switched-on

website refresh completed. End of February/March

08 work plan Corporate communications experts

group scheduled for 19th February to further

progress. Build proposal document for reaching

unengaged CPs once agreed proposed work will

progress. Next working group planned for 7th

March.

- RAG status Green

- Key issues

- 1) how to reach non-engaged CPs.

- 2) Perceived lack of clarity on migration

strategies. - 3) Time status remains amber as CPs have frozen

their own comms depending Voice Strategy outcome

Time (G)

Cost (G)

Quality (G)

Customer Sat. (G)

Information (G)

Status

13

Migration communications reseller communications

- RAG status Green

- Key information

- 1) Perceived lack of clarity on migration

strategies. Michael Eagle reported a perceived

disenchantment due to lack of uncertainty

information on the programme - 2) Time status remains amber as CPs have frozen

their own comms depending Voice Strategy outcome

February 08 achievements / March08 plan Webcalls

see details on first slide for webcalls

held/planned. E-newsletter there are currently

461 people registered on the reseller database to

receive future newsletters, invites

etc Measurement of reseller communication

campaign effectiveness Questions previously

developed and the three groups for surveying are

decided (those on the reseller database who

attended one of the events, those on the reseller

database who did not attended one of the events

and those on the Miles Publishing database. The

research survey will now take place in July End

January/ February work plan Next working group

planned for 15th February. Frequency of future

working groups to be a discussion item at the

next working group.

Time (G)

Cost (G)

Quality (G)

Customer Sat. (G)

Information (G)

Status

14

Contracts (MSA)

- RAG Status Amber

- Key Issues (For Discussion)

- SLA numbers for MSIL were included but too late

for a considered industry view - WBC product due for launch in April 08, need to

commence contract review immediately

Key Milestones Jan/Feb Achievements Initial

information sent out for WBC product discussion

at the Feb WG Fuller update to be provided post

the WG

Feb/Mar Work plan

Commence WBC driven discussions with view to next

issue of MSA to incorporate shortfalls

identified February meeting put back to 25th Feb

to accommodate draft issue of WBC product

information March meeting now 17th March

Time (A)

Cost (G)

Quality (G)

Customer Sat. (G)

Information (A)

Status

15

WG Issues RAGs

- Working Group Issues are defined as problems that

are within the WG scope and will impede the

progress of the WG and cannot be totally

resolved, without delaying known milestones, by

the WG without outside help. - The outside help will be triggered by a formal

escalation. Any WG that has one or more

escalations currently flagged will be deemed to

be in status Red (shown against time indicator).

If an issue has the potential to delay a key

milestone it should raise an Amber status flag,

but no formal escalation will be raised. Once the

escalation has been dealt with and appropriate

guidance given the escalation will be closed and

the WG status will revert. - Other WG RAG status influences will be Cost,

Quality Customer Satisfaction Information, as

in table below.