Depreciation Methods - PowerPoint PPT Presentation

1 / 19

Title:

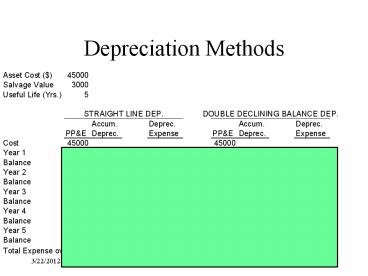

Depreciation Methods

Description:

Is there any cash outflow associated with depreciation expense? ... depreciation? Over the life of the asset, is there a difference in total depreciation ... – PowerPoint PPT presentation

Number of Views:1846

Avg rating:3.0/5.0

Title: Depreciation Methods

1

Depreciation Methods

2

Depreciation Methods

3

Depreciation Methods

4

Depreciation Methods

5

Depreciation Methods

6

Depreciation Methods

7

Depreciation Methods

8

Depreciation Methods

9

Depreciation Methods

10

Depreciation Methods

11

Depreciation Methods

12

Depreciation Methods

13

Questions on Depreciation Methods

- Does book value reflect market value?

- Is there any cash outflow associated with

depreciation expense? - Which method is more conservative in the early

years of an assets life? Why? - Why do companies use straight line depreciation?

- Over the life of the asset, is there a difference

in total depreciation expense? - The asset is sold for 15,000 at the end of the

third year. Compute the gain or loss.

14

Amounts needed for ratio analysis

Not used this semester

15

Amounts needed for ratio analysis

Not used this semester

16

Utilization Fixed Asset Turnover

Not used this semester

The higher the ratio the better. PPA are

efficiently utilized.

17

Factors affecting Fixed Asset Turnover

- Compare to industry averages

- 7.0 Vs. 34.2, 13.1, 6.2

- Newer, more expensive equipment would cause

average PPE-net to be higher. - Competitors may lease equipment (it may not show

up as PPE). - Accelerated depreciation would cause average

PPE-net to be lower.

Not used this semester

18

Percentage of PPE Depreciated (AGE)

Not used this semester

19

Factors affecting AGE

- No industry average to compare to

- Numerator- Accumulated Depreciation is affected

by depreciation method selected. - What would you expect this ratio to be for a

company like Cannondale?

Not used this semester