Oligopoly Models - PowerPoint PPT Presentation

1 / 26

Title:

Oligopoly Models

Description:

Oligopoly Models. There are three dominant oligopoly models. Cournot (quantity) Bertrand (price) ... But each embodies the Nash equilibrium concept ... – PowerPoint PPT presentation

Number of Views:641

Avg rating:3.0/5.0

Title: Oligopoly Models

1

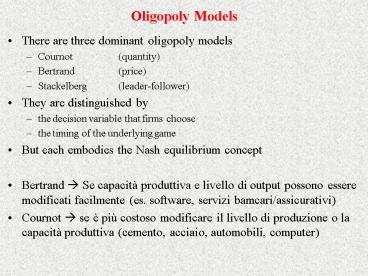

Oligopoly Models

- There are three dominant oligopoly models

- Cournot (quantity)

- Bertrand (price)

- Stackelberg (leader-follower)

- They are distinguished by

- the decision variable that firms choose

- the timing of the underlying game

- But each embodies the Nash equilibrium concept

- Bertrand ? Se capacità produttiva e livello di

output possono essere modificati facilmente (es.

software, servizi bamcari/assicurativi) - Cournot ? se è più costoso modificare il livello

di produzione o la capacità produttiva (cemento,

acciaio, automobili, computer)

2

Matrice dei profitti in un gioco sulle quantità

prodotte (Cournot)

3

Cournot example American and United

- Q 339 P demand function

- MC 147 marginal cost

- qA Q(P) qU (339 P) qU demand for A

- qU Q(P) qA (339 P) qA demand for U

- P 339 qA qU inverse demand function

- MRA 339 2qA qU marginal revenue for A

- MRU 339 2qU qA marginal revenue for U

- Max profit ? MR MC

- 339 2qA qU 147

- qA 96 1/2 qU best response function for A

- qU 96 1/2 qA best response function for U

- qA 96 1/2 (96 1/2qA)

- qA 64 qU 64

- Q qA qU 128 P 339 Q 211

4

Monopolio Output che max il profitto per

American Airlines

(a) Monopolio

p

, per

passeggero

339

243

MC

147

D

MR

0

339

169.5

96

q

, Migliaia di passeggeri American Airlines

A

Per quadrimestre

5

Duopolio Output che max il profitto per

American Airlines

(b) Duopolio

p

, per

passeggero

339

275

211

MC

147

q

64

U

r

r

MR

D

D

0

339

275

137.5

64

128

q

, Migliaia di passeggeri American Airlines

A

per quadrimestre

6

Curve di reazione di American e United

q

, United, migliaia

U

di passeggeri per quadr.

192

Curva di reazione di American

96

Equilibrio di Cournot

64

48

Curva di reazione di United

0

192

96

64

q

, American, migliaia di

A

passeggeri per quadrimestre

7

Duopoly Equilibria

(a) Equilibrium Quantities

q

, Thousand United

U

passengers per quarter

192

American

s best-response curve

Contract

curve

Price-taking equilibrium

96

Cournot equilibrium

64

Stackelberg equilibrium

48

Cartel

United

s best-response curve

equilibrium

0

192

96

64

48

q

, Thousand American passengers per quarter

A

8

Cournot equilibrium and the number of firms

- MR P(1 1/?r) ?r elasticity of the residual

demand curve - ?r n? ? market elasticity of demand

- n number of competing firms

- MR P(1 1/n?) MC

- n 1 ? monopoly

- n 8 ? perfect competition

- Lerner Index (P MC) / P - 1 / n?

9

Cournot Equilibrium Varies with the Number of

Firms

10

The Cournot Model

- Start with a duopoly

- Two firms making an identical product (Cournot

supposed this was spring water) - Demand for this product is

P A - BQ A - B(q1 q2)

where q1 is output of firm 1 and q2 is output of

firm 2

- Marginal cost for each firm is constant at c per

unit - To get the demand curve for one of the firms we

treat the output of the other firm as constant - So for firm 2, demand is P (A - Bq1) - Bq2

11

The Cournot model (cont.)

If the output of firm 1 is increased the demand

curve for firm 2 moves to the left

P (A - Bq1) - Bq2

The profit-maximizing choice of output by firm 2

depends upon the output of firm 1

A - Bq1

A - Bq1

Marginal revenue for firm 2 is

Solve this for output q2

Demand

c

MC

MR2 (A - Bq1) - 2Bq2

MR2

MR2 MC

q2

Quantity

A - Bq1 - 2Bq2 c

? q2 (A - c)/2B - q1/2

12

The Cournot model (cont.)

q2 (A - c)/2B - q1/2

This is the best response function for firm 2

It gives firm 2s profit-maximizing choice of

output for any choice of output by firm 1

There is also a best response function for firm 1

By exactly the same argument it can be written

q1 (A - c)/2B - q2/2

Cournot-Nash equilibrium requires that both firms

be on their best response functions.

13

Cournot-Nash Equilibrium

q2

The best response function for firm 1 is q1

(A-c)/2B - q2/2

If firm 2 produces (A-c)/B then firm 1 will

choose to produce no output

The Cournot-Nash equilibrium is at Point C at the

intersection of the best response functions

(A-c)/B

Firm 1s best response function

If firm 2 produces nothing then firm 1 will

produce the monopoly output (A-c)/2B

The best response function for firm 2 is q2

(A-c)/2B - q1/2

(A-c)/2B

C

qC2

Firm 2s best response function

q1

(A-c)/2B

(A-c)/B

qC1

14

Cournot-Nash Equilibrium

q1 (A - c)/2B - q2/2

q2

q2 (A - c)/2B - q1/2

(A-c)/B

? q2 (A - c)/2B - (A - c)/4B q2/4

Firm 1s best response function

? 3q2/4 (A - c)/4B

(A-c)/2B

? q2 (A - c)/3B

C

(A-c)/3B

? q1 (A - c)/3B

Firm 2s best response function

q1

(A-c)/2B

(A-c)/B

(A-c)/3B

15

Cournot-Nash Equilibrium (cont.)

- In equilibrium each firm produces qC1 qC2 (A

- c)/3B - Total output is, therefore, Q 2(A - c)/3B

- Recall that demand is P A - BQ

- So the equilibrium price is P A - 2(A - c)/3

(A 2c)/3 - Profit of firm 1 is (P - c)qC1 (A - c)2/9

- Profit of firm 2 is the same

- A monopolist would produce QM (A - c)/2B

- Competition between the firms causes their total

output to exceed the monopoly output. Price is

therefore lower than the monopoly price - But output is less than the competitive output (A

- c)/B where price equals marginal cost and P

exceeds MC

16

Numerical Example of Cournot Duopoly

- Demand P 100 - 2Q 100 - 2(q1 q2) A

100 B 2 - Unit cost c 10

- Equilibrium total output Q 2(A c)/3B 30

- Individual Firm output q1 q2 15

- Equilibrium price is P (A 2c)/3 40

- Profit of firm 1 is (P - c)qC1 (A - c)2/9B

450 - Competition Q (A c)/B 45 P c 10

- Monopoly QM (A - c)/2B 22.5 P 55

- Total output exceeds the monopoly output, but is

less than the competitive output - Price exceeds marginal cost but is less than the

monopoly price

17

Cournot-Nash Equilibrium (cont.)

- What if there are more than two firms?

- Much the same approach.

- Say that there are N identical firms producing

identical products - Total output Q q1 q2 qN

- Demand is P A - BQ A - B(q1 q2 qN)

- Consider firm 1. Its demand curve can be

written

This denotes output of every firm other than firm

1

P A - B(q2 qN) - Bq1

- Use a simplifying notation Q-1 q2 q3 qN

- So demand for firm 1 is P (A - BQ-1) - Bq1

18

The Cournot model (cont.)

If the output of the other firms is increased the

demand curve for firm 1 moves to the left

P (A - BQ-1) - Bq1

The profit-maximizing choice of output by firm 1

depends upon the output of the other firms

A - BQ-1

A - BQ-1

Marginal revenue for firm 1 is

Solve this for output q1

Demand

c

MC

MR1 (A - BQ-1) - 2Bq1

MR1

MR1 MC

q1

Quantity

A - BQ-1 - 2Bq1 c

? q1 (A - c)/2B - Q-1/2

19

Cournot-Nash Equilibrium (cont.)

q1 (A - c)/2B - Q-1/2

As the number of firms increases output of each

firm falls

How do we solve this for q1?

The firms are identical. So in equilibrium

they will have identical outputs

? Q-1 (N - 1)q1

As the number of firms increases aggregate

output increases

? q1 (A - c)/2B - (N - 1)q1/2

As the number of firms increases price tends

to marginal cost

As the number of firms increases profit of each

firm falls

? (1 (N - 1)/2)q1 (A - c)/2B

? q1(N 1)/2 (A - c)/2B

? q1 (A - c)/(N 1)B

? Q N(A - c)/(N 1)B

? P A - BQ (A Nc)/(N 1)

Profit of firm 1 is P1 (P - c)q1

(A - c)2/(N 1)2B

20

Concentration and Profitability

- Assume that we have N firms with different

marginal costs - We can use the N-firm analysis with a simple

change - Recall that demand for firm 1 is P (A - BQ-1) -

Bq1 - But then demand for firm i is P (A - BQ-i) -

Bqi - Equate this to marginal cost ci

But Q-i qi Q and A - BQ P

A - BQ-i - 2Bqi ci

This can be reorganized to give the equilibrium

condition

A - B(Q-i qi) - Bqi - ci 0

? P - Bqi - ci 0

? P - ci Bqi

21

Concentration and profitability (cont.)

The price-cost margin for each firm is determined

by its own market share and overallmarket demand

elasticity

P - ci Bqi

Divide by P and multiply the right-hand side by

Q/Q

The verage price-cost margin is determined by

industryconcentration as measured by the

Herfindahl-Hirschman Index

P - ci

BQ

qi

P

P

Q

But BQ/P 1/? and qi/Q si

P - ci

si

so

?

P

Extending this we have

P - c

H

P

?

22

Misura della concentrazione

- Le industrie presentano strutture molto

differenti - Numero e distribuzione dimensionale delle imprese

- cereali da colazione alta concentrazione

- ristoranti bassa concentrazione

- Come misurare la struttura di mercato

- misura riassuntiva

- la curva di concentrazione è possibile

- preferenza per un numero singolo

- Rapporto di concentrazione o Indice di

Herfindahl-Hirschman

23

- Indice di Herfindahl-Hirschman

- Informazioni sulle quote di mercato di tutte le

imprese e non solo di quelle più grandi. - HH ? si2

- si quota di mercato impresa i-esima

- Somma dei quadrati delle quote di mercato delle

imprese del settore.

24

Misura della concentrazione

- Confronto tra due diverse misure della

concentrazione

Imprese Quota mercato Quota di

mercato ordinate () al

quadrato

1 25

25

625

2 25

25

625

3 25

25

625

4 5

5

25

5 5

25

6 5

25

7 5

25

8 5

25

CR4 80

Indice di concentrazione

HH 2.000

25

- Lindice di concentrazione è influenzato da,

esempio, fusioni

Imprese Quota mercato Quota di

mercato ordinate () al

quadrato

1 25

Esempio imprese 4 e 5 decidono di fondersi

25

Cambiamento quota di mercato

625

2 25

25

625

3 25

25

625

4 5

5

25

100

10

5 5

25

6 5

Lindice di concentrazione cambia

25

7 5

25

8 5

25

CR4 80

Indice di concentrazione

HH 2.000

85

2.050

26

(No Transcript)